Importance of Monitoring Barclays Share Price

The share price of Barclays PLC is a critical indicator for investors, reflecting the company’s performance, market perception, and wider economic conditions. As one of the leading banks in the UK, fluctuations in its share price can have significant implications for the financial market and individual investors’ portfolios.

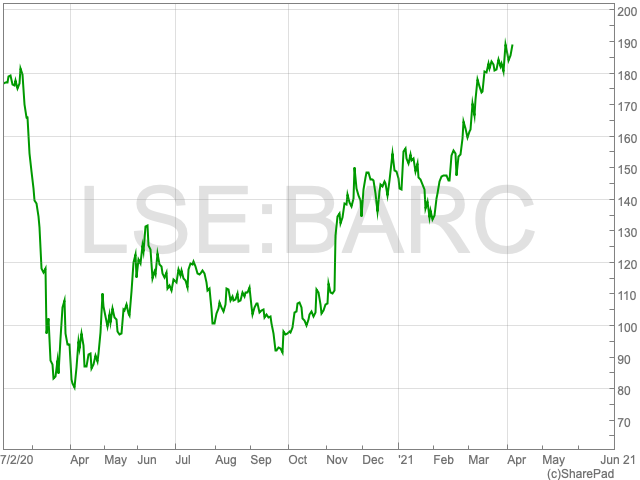

Recent Performance of Barclays Share Price

As of October 2023, Barclays shares have displayed volatility amidst global economic challenges, including rising interest rates and inflationary pressures. The share price saw a peak earlier in the month, reaching approximately £1.60 before experiencing a slight decline due to investor concerns regarding the bank’s future profitability amid tightening monetary policy.

Analysts have pointed out that the bank’s performance in the third quarter could influence its share price trajectory. Barclays reported a robust first half of 2023, driven by strong trading revenues and a well-managed cost base. However, pressures from the UK housing market and international trade disputes pose risks to its sustainability moving forward.

Investors’ Outlook

Market sentiment surrounding Barclays remains cautiously optimistic, with many investors eyeing signals from the bank’s upcoming earnings report, scheduled for later this month. If Barclays manages to outperform analysts’ expectations and provide a solid outlook, it could lead to a rebound in its share price.

Investment experts suggest that maintaining a diversified portfolio is essential in such uncertain times. Monitoring the macroeconomic factors and the bank’s strategic decisions will be crucial for investors as they assess the potential risks and rewards associated with Barclays shares.

Conclusion: The Significance for Investors

Understanding the movements of Barclays share price is vital for stakeholders, given its influence on the UK banking sector. With ongoing economic fluctuations, the future trajectory of Barclays’ shares will likely fluctuate based on how well the bank adapts to the current challenges. Investors are encouraged to stay informed on financial trends, company announcements, and broader market dynamics to navigate their investment strategies effectively.