Introduction

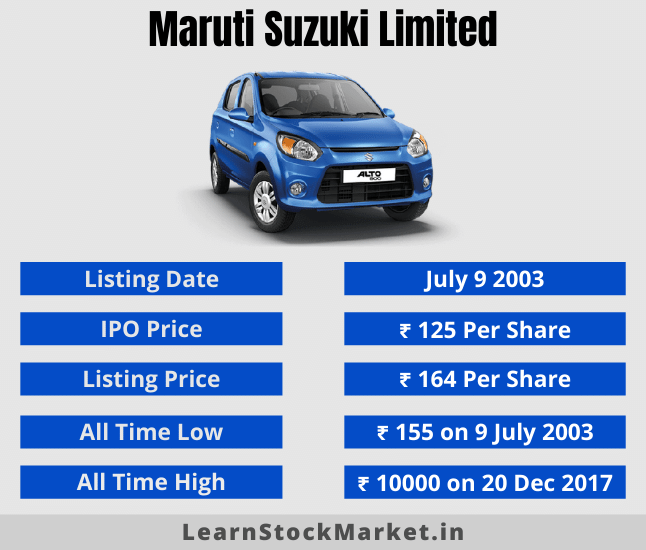

The share price of Maruti Suzuki, a leading automobile manufacturer in India, plays a crucial role in reflecting the health of the Indian automotive market. As a bellwether stock in this sector, fluctuations in Maruti’s share price not only affect investors but can also signify broader economic trends. With the current volatility in global markets and changing consumer behaviours, it’s essential to interpret what these movements say about the company and the industry.

Current Share Price Analysis

As of October 2023, Maruti’s share price has experienced notable fluctuations, trading between ₹8,500 to ₹9,200 in recent weeks. Analysts attribute this volatility partially to the ongoing global semiconductor shortage, which has significantly impacted the automotive sector. Maruti, which has a substantial market share in India, has been proactive in managing its supply chain, yet challenges remain.

Recent Developments

In addition to supply chain issues, Maruti recently announced new models and enhancements to existing lines, which are aimed at attracting consumers looking for advanced technological features in vehicles. The anticipation surrounding these launches has contributed positively to investor sentiment, with many analysts predicting a potential increase in sales volume and market share in the upcoming quarters.

Market Reactions

Investors are watching key financial indicators closely, as Maruti reports its Q2 results next month. Early indicators suggest that the company may report robust sales figures despite external pressures. If these predictions hold true, it could lead to a positive reassessment of Maruti’s share price, pushing it toward the ₹10,000 mark. Conversely, any negative surprises related to production or profit margins could result in a bearish trend.

Conclusion

The Maruti share price remains a critical indicator for both investors and industry analysts. Observing current trends, consumer demand, and the company’s strategic initiatives may provide valuable insights into future pricing and market strategies. Given the global automotive industry’s uncertainties, including fluctuating raw material costs and changing regulations, stakeholders should remain vigilant. Maruti’s potential to recover and thrive amidst these challenges will be essential for its share performance going forward.