The Rise of Cryptocurrency Trading

Cryptocurrency trading has become an important topic in the financial landscape, increasingly drawing interest from both retail and institutional investors. With the growing acceptance of digital assets globally, trading platforms have seen a surge in activity, reflecting a wider trend towards digital finance.

Market Trends in 2023

As of 2023, the cryptocurrency market has demonstrated significant resilience following the downturn experienced during 2022. Bitcoin, the leading cryptocurrency, has gained traction again, surpassing $40,000 amid a broader market recovery. Ethereum and other altcoins are also observing upward trends, contributing to a bullish market sentiment.

One major factor driving this resurgence is the increasing institutional adoption of cryptocurrencies. Companies like MicroStrategy and Tesla have reaffirmed their investments in Bitcoin, and traditional financial institutions are increasingly offering crypto-related services to their clients. The entry of established players is giving more credibility to the market.

Regulatory Landscape

The regulatory environment continues to evolve, impacting cryptocurrency trading significantly. In 2023, the Financial Conduct Authority (FCA) in the UK has introduced new guidelines aimed at protecting investors and ensuring market integrity. Such measures could help prevent the rampant fraud and security issues that plagued the market previously.

Technological Innovations

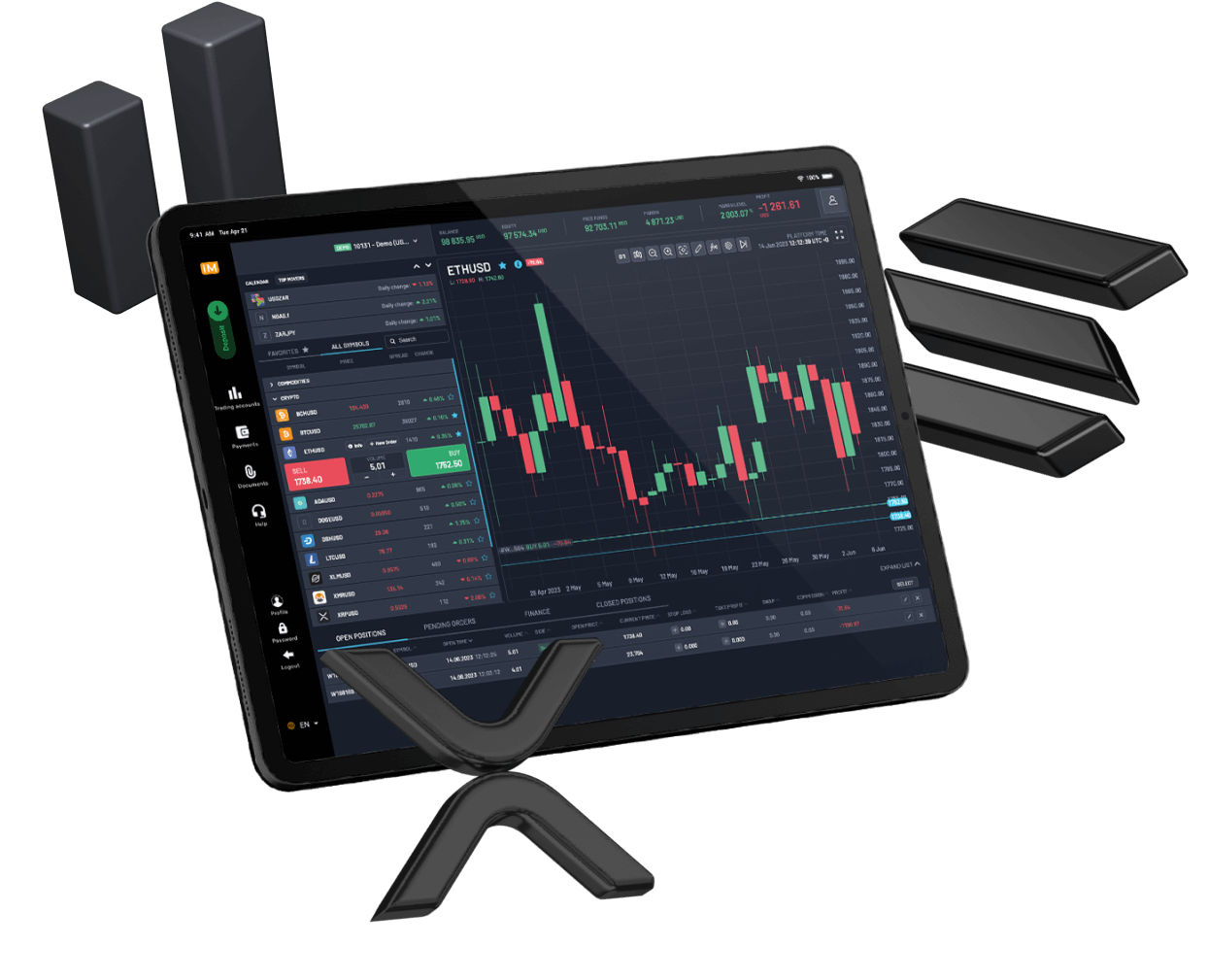

Additionally, the technological landscape surrounding cryptocurrency trading is rapidly advancing. Decentralised finance (DeFi) platforms are gaining popularity, offering innovative trading solutions and higher yields compared to traditional banks. Meanwhile, the emergence of non-fungible tokens (NFTs) continues to influence trading behaviours, drawing new investors to the market.

Conclusion and Future Considerations

As cryptocurrency trading evolves, potential investors must remain informed and vigilant. The volatile nature of the market, while presenting opportunities for profit, also includes significant risks. As we continue through 2023, analysts predict an increasing focus on regulatory compliance and educational resources for traders. Stakeholders in the market should prepare for an even more dynamic trading environment.

In summary, cryptocurrency trading is at a pivotal point, with technological advances and regulatory frameworks shaping its future. As interest continues to grow, staying informed on the latest developments will be crucial for anyone involved in the market.