Introduction

Cryptocurrency trading has become an increasingly significant component of the global financial landscape. With rising popularity and adoption, the cryptocurrency market is projected to continue evolving, affecting traditional financial systems. Understanding the trends and implications of cryptocurrency trading in 2023 is crucial for investors, policymakers, and the general public alike.

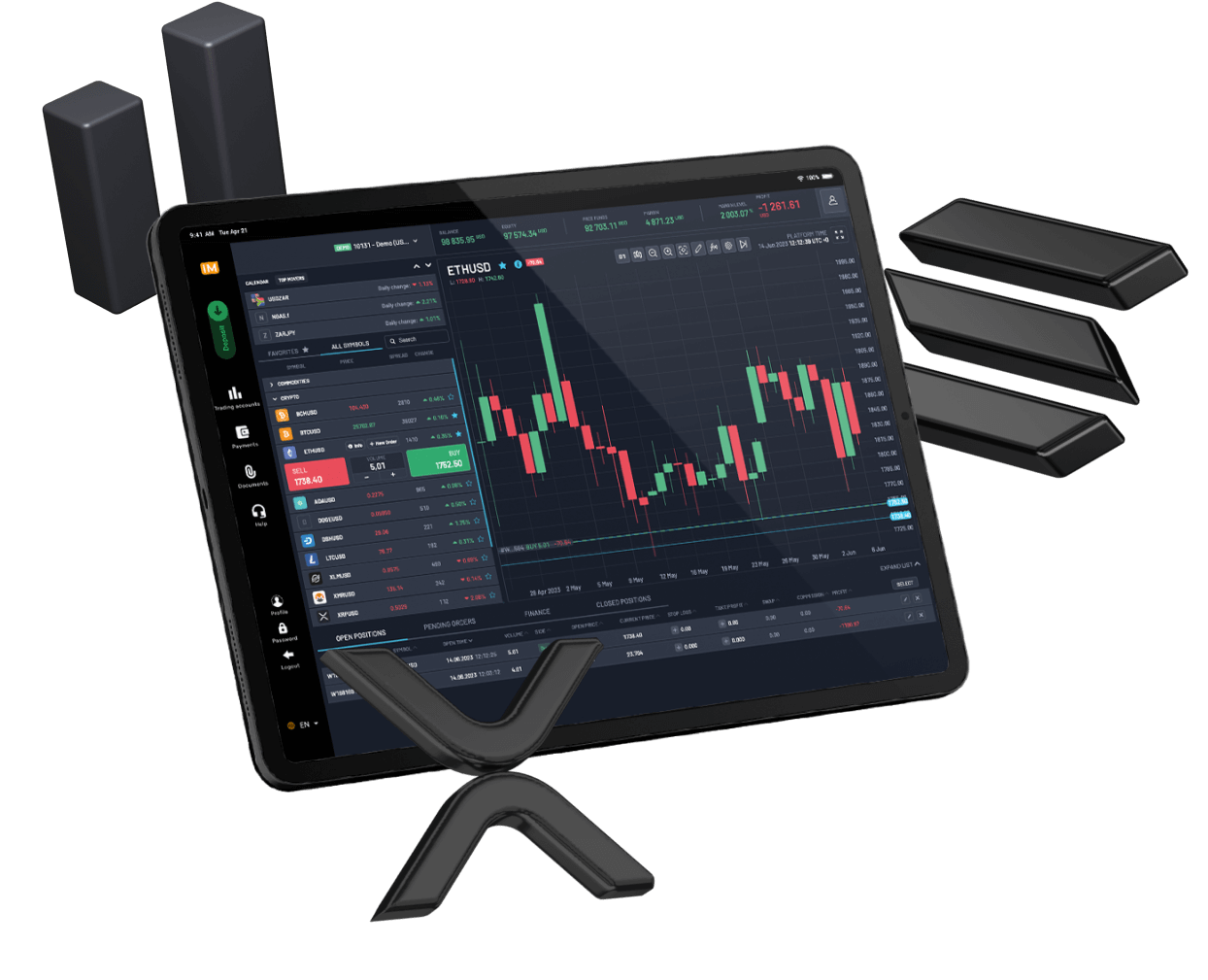

Current Market Overview

As of early 2023, the cryptocurrency market has shown resilience following the downturn in 2022. Bitcoin, the leading cryptocurrency, has seen fluctuations in value but remains a point of interest for many traders. Ethereum and other altcoins have also regained momentum and captured market share, driven by factors such as technological advancements and increased institutional investment. Notably, the total market capitalization of cryptocurrencies is fluctuating around the $1 trillion mark, indicating a recovery in investor confidence.

Key Trends in Cryptocurrency Trading

1. Regulatory Developments: Governments worldwide are integrating regulatory frameworks for cryptocurrencies to enhance market stability and protect investors. The implementation of clearer guidelines can significantly attract institutional investors who seek legitimacy in the market.

2. Decentralised Finance (DeFi): The rise of DeFi platforms continues to impact trading significantly. DeFi allows users to trade assets without intermediaries, promoting transparency and potentially higher returns for investors. The growth of DeFi signifies a shift in traditional financial mechanisms, encouraging more users to participate in cryptocurrency trading.

3. Integration of Artificial Intelligence: Advances in AI technology are reshaping trading strategies. AI-enhanced trading tools are taking centre stage, allowing traders to leverage data analytics for better decision-making and improved trading outcomes. Machine learning algorithms are providing insights into market trends and sentiment analysis, making trading more accessible and efficient.

Conclusion

As cryptocurrency trading continues to evolve, it is vital for participants to stay informed about market trends, regulatory changes, and technological advancements. The significance of cryptocurrency trading lies not only in its investment potential but also in its capability to disrupt conventional finance. Looking ahead, increased adoption and improved regulatory clarity may further legitimise the industry, influencing both individual traders and institutional players. Understanding these dynamics will be essential for anyone interested in navigating the world of cryptocurrency trading in the years to come.