Introduction

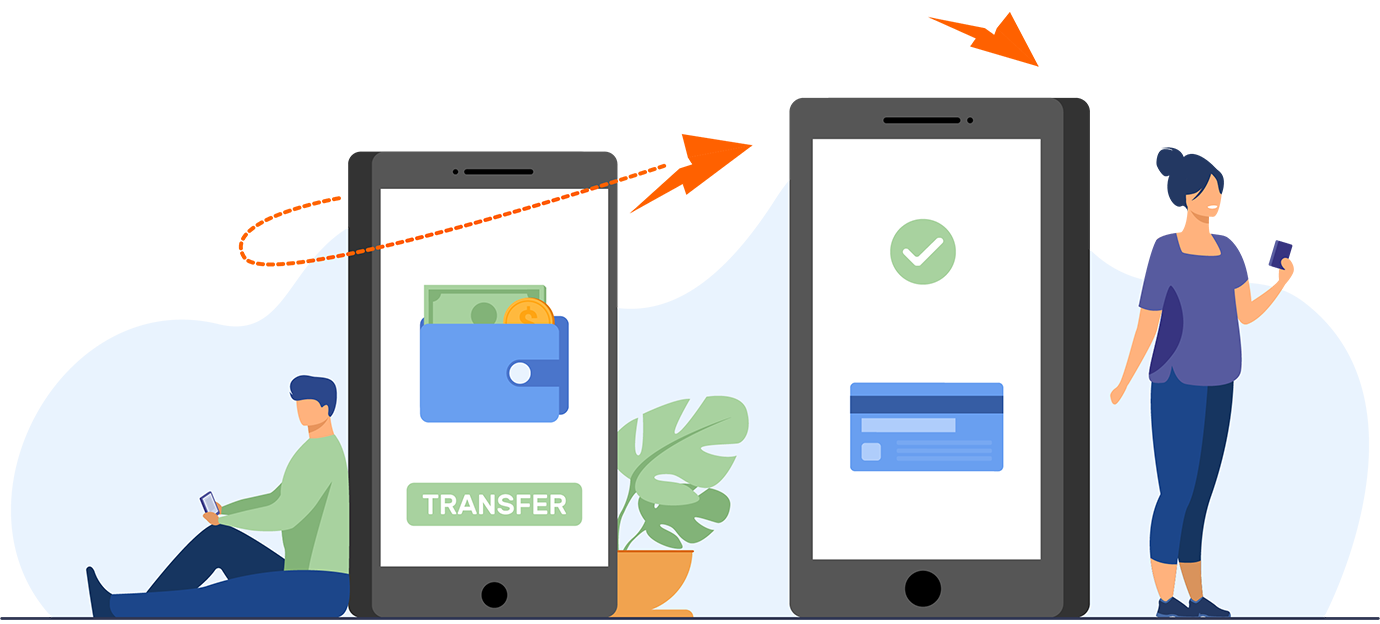

Money transfer services play a pivotal role in the global economy, facilitating the movement of funds across borders and enabling individuals and businesses to access financial resources efficiently. With the rise of digital payment platforms, the demand for quick and secure money transfers has surged, especially during times of crises or economic challenges. Understanding how these services operate and their implications for users is essential in an increasingly globalised world.

Current Landscape of Money Transfers

In 2023, the money transfer industry has seen significant advancements due to technology. Companies like Wise, Western Union, and PayPal have adopted new technologies to offer faster, cheaper, and more secure services. The World Bank reported that global remittances reached an estimated $630 billion in 2022, underscoring the importance of these financial services for millions of families around the world. Mobile money transfers, particularly in developing regions, have enabled users to send money using just their mobile phones, fostering economic growth.

Key Developments

One of the notable trends within the money transfer space is the increasing adoption of cryptocurrencies as a means for international transfers. Platforms like Bitcoin and Ethereum are gaining traction as they offer lower fees and faster transactions compared to traditional methods. Additionally, regulations surrounding digital currencies are beginning to take shape, with countries like the UK and US working on frameworks to ensure consumer protection while enabling innovation.

Another significant event in the money transfer landscape is the shift towards social media integration. Companies are increasingly allowing users to send money through popular social platforms, thus providing more convenient access to funds. For instance, Venmo and Cash App are examples of services that integrate social sharing aspects to encourage peer-to-peer transactions.

Challenges and Considerations

Despite the advances in money transfer technology, challenges remain. Issues such as fraud, regulatory compliance, and currency fluctuations can pose risks for users. Furthermore, high fees still affect many migrant workers who rely on remittances to support their families back home, emphasising the continued need for competition and regulation within the industry.

Conclusion

In summary, money transfer services are more relevant than ever in our global economy, providing vital support for millions around the world. As technology continues to evolve, it is critical for consumers to stay informed about their options and the associated risks. Anticipating further innovations and regulatory responses in the money transfer sector will help empower users to make informed decisions, allowing them to effectively manage their finances in an interconnected world.