Introduction to Mbanq

Mbanq is rapidly emerging as a key player in the digital banking sector, providing comprehensive banking-as-a-service (BaaS) solutions to financial institutions across the globe. In an era where digital transformation is paramount, Mbanq’s offerings have become increasingly relevant to banks and fintechs looking to innovate and enhance customer experiences.

What is Mbanq?

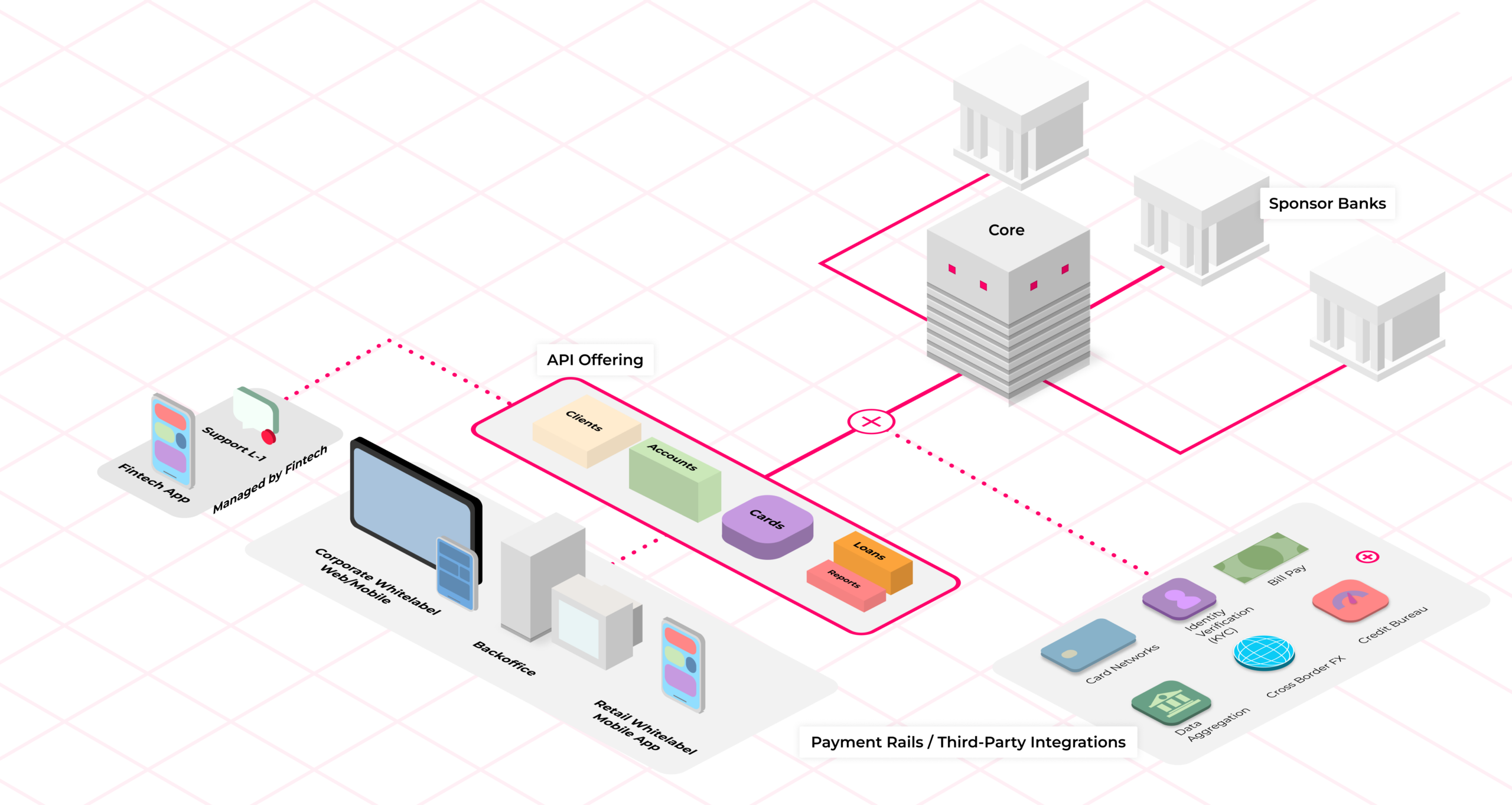

Mbanq, founded in 2018 and headquartered in San Francisco, California, aims to empower financial institutions through its robust technology platform. The firm provides a modular suite of banking services, including core banking systems, digital banking applications, compliance and risk management solutions, and customer engagement tools. This allows customers to launch new products quickly and respond agilely to market needs.

Recent Developments

As of late 2023, Mbanq has expanded its global footprint, partnering with multiple banks and fintech companies in Europe, Asia, and North America. Notable collaborations include a partnership with a European fintech aimed at launching a fully digital banking experience. Moreover, Mbanq has been at the forefront of integrating Artificial Intelligence (AI) into their offerings, enhancing features such as credit scoring and customer service automation.

The company recently unveiled its latest product, Mbanq AI Advisor, which utilises machine learning algorithms to offer personalised financial advice to users, furthering their commitment to innovation in the banking sector.

Importance of Mbanq

The significance of Mbanq lies in its capacity to provide flexibility and rapid deployment, critical factors for financial institutions striving to stay competitive in a saturated market. As traditional banks face pressure to adapt and innovate, Mbanq’s solutions allow them to incorporate cutting-edge technology without incurring the typical overhead of building these capabilities from scratch.

Conclusion

In conclusion, Mbanq is not just reshaping how banks operate but is also paving the way for future innovations in digital finance. As the financial landscape evolves, the emphasis on digital solutions and customer-centric approaches will only increase. With Mbanq at the helm of this transformation, we can expect to see an even greater push towards efficient, modern financial services that cater to the needs of the 21st-century consumer. The future of banking appears bright with Mbanq leading the charge.