The Significance of Meta’s Stock Price

The stock price of Meta Platforms, Inc., the social media giant known for Facebook, Instagram, and WhatsApp, is a crucial indicator of its market performance and company health. As a major player in the technology sector, Meta’s valuation impacts not only its investors but also the broader tech market and economy.

Recent Trends in Meta’s Stock Price

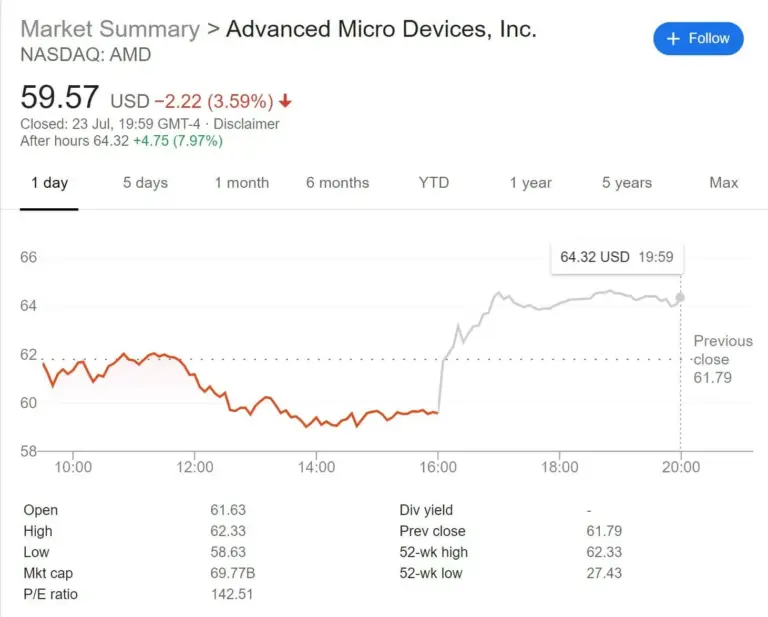

As of October 2023, Meta’s stock price has experienced considerable fluctuations, influenced by various factors such as changes in user engagement, advertising revenue, and regulatory scrutiny. Following a robust recovery in 2023 after a significant dip in the prior year, the stock price rose steadily, reflecting increased consumer confidence and improved financial results.

In Q2 2023, Meta reported an impressive 25% year-on-year increase in revenue, bolstered by a successful rebranding strategy and enhanced advertising options. This growth had a directly positive impact on its stock price, leading to a surge that saw shares trading near $350. However, ongoing challenges such as competition from TikTok and privacy concerns continue to create volatility in Meta’s market performance.

Factors Influencing Meta’s Stock Price

Several key factors currently influence Meta’s stock price and market performance:

- Regulatory Challenges: Increased regulation and scrutiny over data privacy practices affect investor confidence.

- Advertising Revenue: As a primary revenue source, fluctuations in advertising spend heavily impact stock trends.

- Market Competition: Competition from other social media platforms, particularly TikTok, continues to challenge user growth and retention.

Future Outlook and Predictions

Financial analysts express cautious optimism regarding Meta’s stock price for the upcoming quarters. Many predict that with continued innovation in virtual and augmented reality, alongside improved advertising performance, Meta could maintain a positive trajectory. However, investors remain vigilant due to the unpredictable nature of technology stocks and potential market corrections.

Conclusion

In conclusion, understanding the current Meta stock price is essential for investors, analysts, and anyone interested in the tech industry. While the company’s performance shows promise, fluctuating market conditions, regulatory pressures, and competitive challenges will remain significant factors. Keeping abreast of Meta’s financial health and market strategies will be key for those looking to navigate its stock movements successfully.