Introduction

The ongoing shift towards digital banking has led to a significant reduction in the number of physical branches operated by traditional banks, including Santander. As a major financial institution in the UK, understanding the implications of these closures is essential for customers and stakeholders alike.

Recent Developments

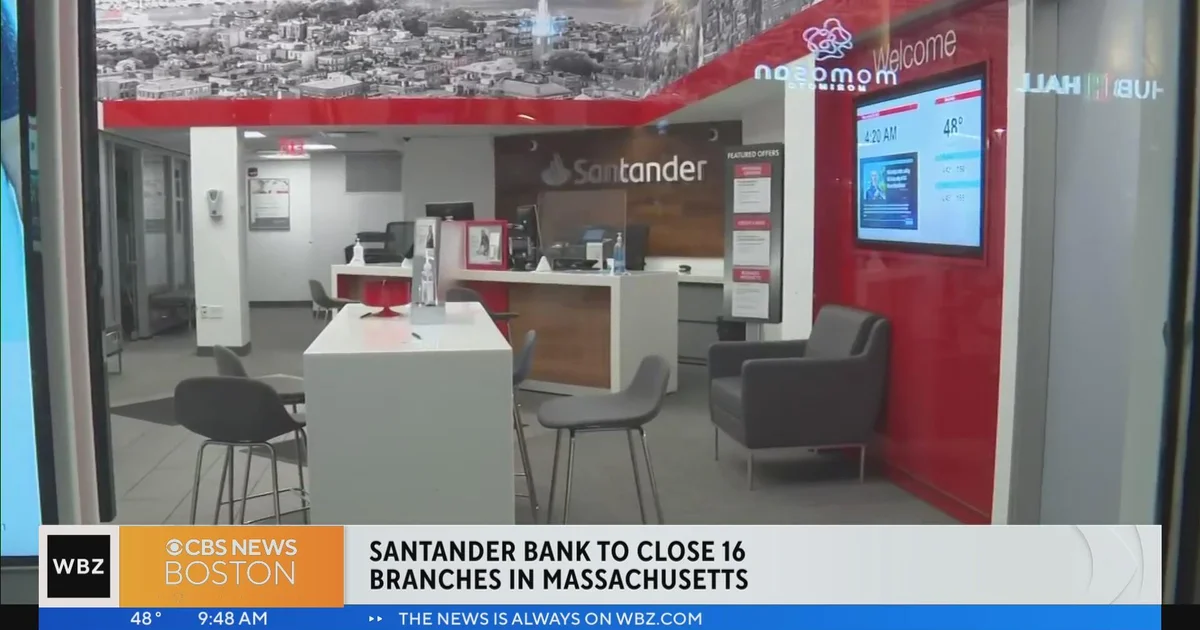

In a recent announcement, Santander UK confirmed plans to close 111 branches across the country by the end of this year, a decision impacting various communities. This reduction, which accounts for nearly one-fifth of their physical locations, is part of a broader strategic shift amid declining footfall at these outlets.

Many of the branches set for closure are situated in urban areas, where online banking has become the norm. However, Santander has committed to ensuring that customers are not left without support. The bank plans to enhance its digital services, offering additional investment in technology to accommodate the growing need for online banking solutions.

Impact on Customers

The decision to close branches will affect thousands of customers, particularly those who rely on in-person banking services. For many, the loss of a local branch could mean increased travel times or challenges in accessing banking services. The bank has assured customers that alternative service options will be available, through either local Post Offices or enhanced online services.

Furthermore, Santander has stated that customers affected by these closures will receive adequate notice and detailed information on how to access banking services in the future. Additionally, the bank is offering support through phone consultations and mobile banking tutorials to help smooth the transition.

Conclusion

The closures of Santander branches signal a significant transformation within the banking sector as it adapts to the demands of modern consumers. As more customers gravitate towards online banking, traditional bank branches may continue to face reductions. For readers, this highlights the importance of staying informed about changes within their banking services and understanding the evolving landscape of financial services. Looking ahead, it is anticipated that other banks may also consider similar measures, marking a pivotal shift in how consumers engage with their financial institutions.