The Importance of Monitoring BT Share Price

The stock market can be a barometer of a company’s health, and the share price of BT Group PLC is a pivotal indicator for investors, analysts, and stakeholders. Understanding fluctuations in BT’s share price is essential for making informed investment decisions, especially in the context of ongoing digital transformation and regulatory challenges within the telecommunications sector. As one of the key players in the UK telecom market, BT’s performance often reflects broader trends in the industry.

Recent Performance of BT Share Price

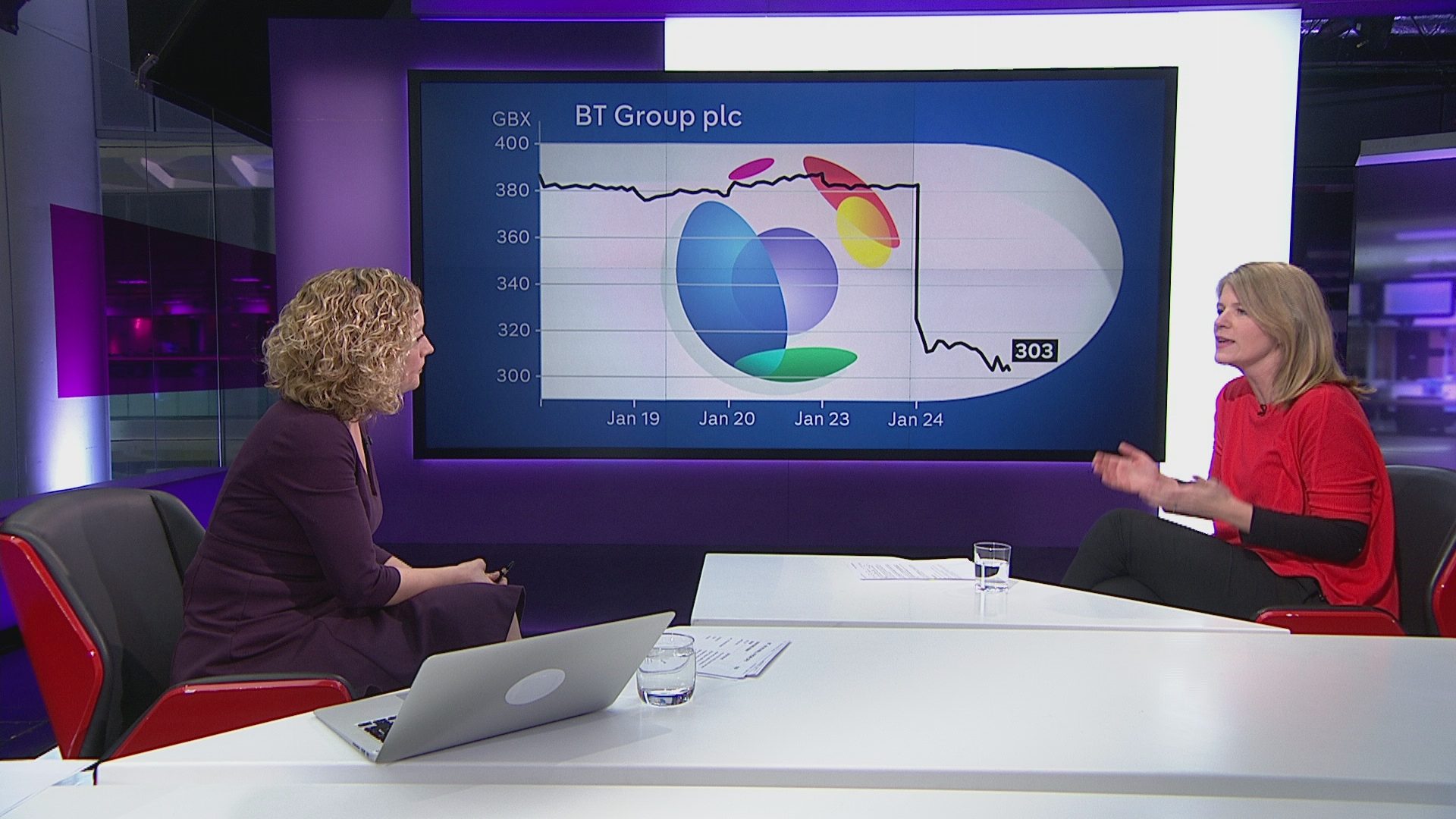

As of October 2023, BT’s share price has experienced notable fluctuations, closing at approximately £1.80, following a modest rise of 3% over the last month. This uptick can be attributed to a positive outlook from analysts regarding BT’s strategic initiatives in expanding its fibre broadband network and the anticipated benefits from improvements in operational efficiency.

Earlier this year, the share price dipped below £1.70 amid concerns around rising operational costs and stiff competition from rivals such as Vodafone and Virgin Media. However, BT’s ongoing efforts to strengthen its position in the market have led to increased investor confidence, which is reflected in the recent share price movements.

Factors Affecting BT Share Price

Several factors can influence the performance of BT’s shares, including regulatory changes, competition, and the overall economic climate. Recently, analysts have pointed to government initiatives to boost digital infrastructure, which bodes well for BT. The company’s investments in expanding its fibre network are expected to yield long-term benefits, potentially driving the share price further upward.

Moreover, shifts in consumer behaviour, particularly the growing demand for high-speed internet and digital services, present both challenges and opportunities for BT. Analysts suggest that if the company can successfully navigate these challenges while improving service offerings, it could enhance its market position and subsequently, its share price.

Future Outlook for BT Share Price

Looking ahead, analysts remain cautiously optimistic about BT’s share price. Projections show that if the company continues to invest prudently in technology and holds a strong competitive edge, it may recover from previous lows and reach higher price points in the next 12 months. However, potential risks, including regulatory changes and macroeconomic factors, should be monitored closely by investors.

In conclusion, the BT share price serves not only as an indicator of BT Group’s current financial health but also as a reflection of its future growth potential. Stakeholders are encouraged to stay abreast of market trends and company announcements to better understand the evolving landscape of telecommunications in the UK.