Introduction

Cryptocurrency trading has evolved dramatically over the past few years, becoming a focal point for investors and finance enthusiasts alike. With the rise of digital currencies such as Bitcoin, Ethereum, and numerous altcoins, the relevance of cryptocurrency trading increased exponentially, allowing individuals to invest in a new class of assets. In 2023, understanding the trends and mechanisms of cryptocurrency trading is essential for potential investors and traders aiming to navigate this complex and often volatile market.

Current Trends in Cryptocurrency Trading

As of mid-2023, several key trends are shaping the cryptocurrency trading landscape:

- Increased Institutional Adoption: Major financial institutions, including PayPal, Fidelity, and Goldman Sachs, are now embracing cryptocurrencies, adding legitimacy to digital assets and attracting more retail investors.

- Regulatory Developments: Governments across the globe are introducing regulations to govern cryptocurrency exchanges and enhance consumer protection. For instance, the EU’s MiCA (Markets in Crypto-Assets) Regulation aims to provide a robust regulatory framework.

- Decentralised Finance (DeFi) Growth: DeFi platforms offer innovative financial services such as lending and yield farming, enabling users to trade and invest in cryptocurrencies outside traditional finance.

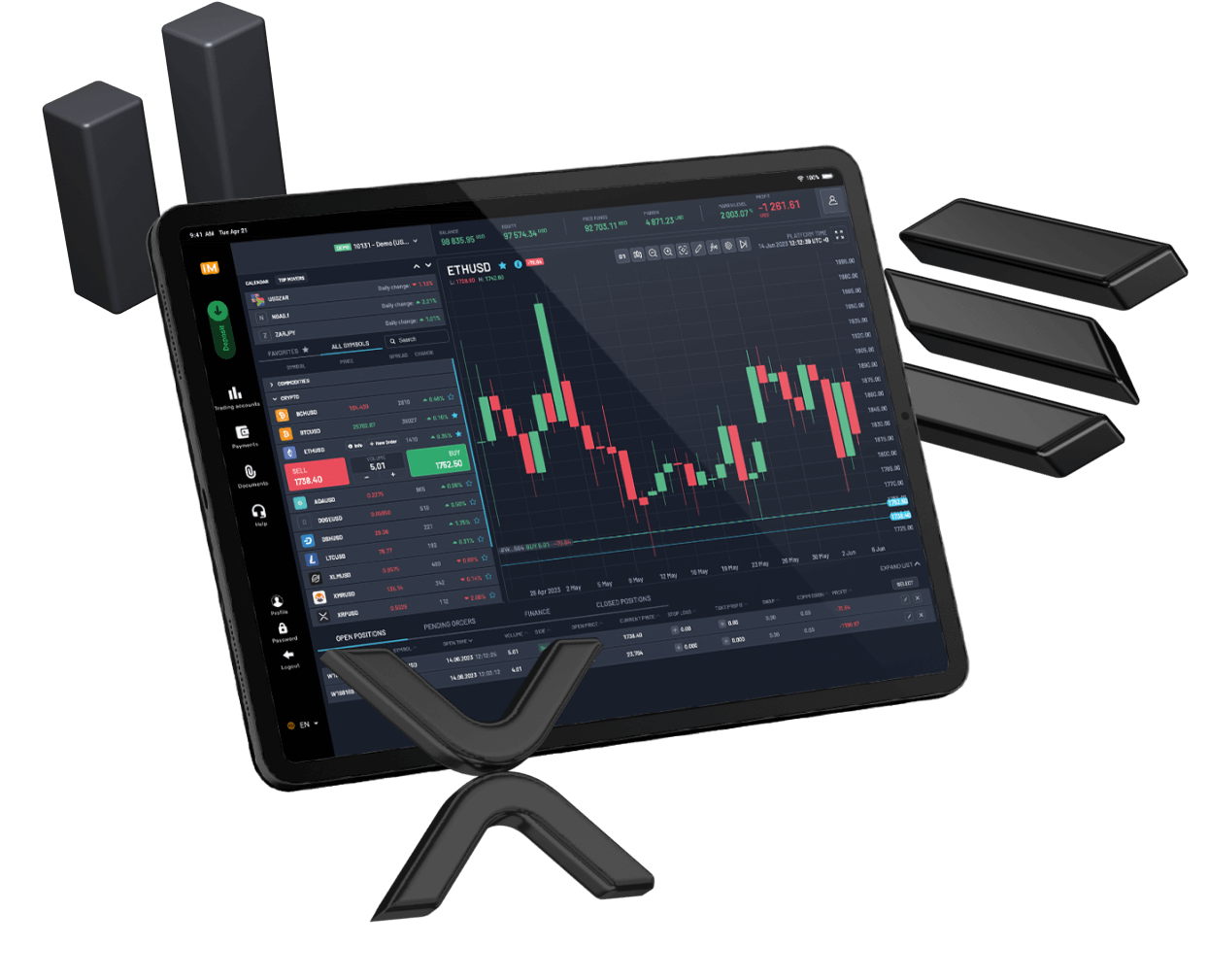

- Trading Platforms Evolution: Advanced trading platforms are developing tools including AI analytics and automated trading systems to help traders make informed decisions quickly.

- NFT Market Impact: Non-fungible tokens (NFTs) continue to be a significant trend. Their success has brought more attention to the blockchain ecosystem, influencing trading strategies.

Risks and Rewards

While cryptocurrency trading can yield substantial rewards, it is essential to acknowledge the risks involved. The market is highly volatile, with prices subject to rapid fluctuations based on market sentiment and global events. Moreover, the potential for fraud and hacking poses significant risks to uninitiated traders. Education, risk management strategies, and due diligence are critical when engaging in cryptocurrency trades.

Conclusion

As cryptocurrency trading becomes increasingly mainstream, understanding its dynamics is crucial for participants in this market. Continued regulatory developments, the embrace of blockchain technology by traditional finance, and the rise of new trading tools will further shape the landscape in the coming years. For investors and traders, staying informed and vigilant is key to capitalising on opportunities and mitigating risks in the ever-evolving world of cryptocurrencies.