Introduction

The stock market remains a critical indicator of economic health, reflecting investor sentiment and corporate performance. Today’s stock market news is especially pertinent as fluctuations can have widespread implications for both individual investors and the broader economy. With ongoing changes influenced by global events and economic policies, understanding the latest trends is essential for informed decision-making.

Market Overview

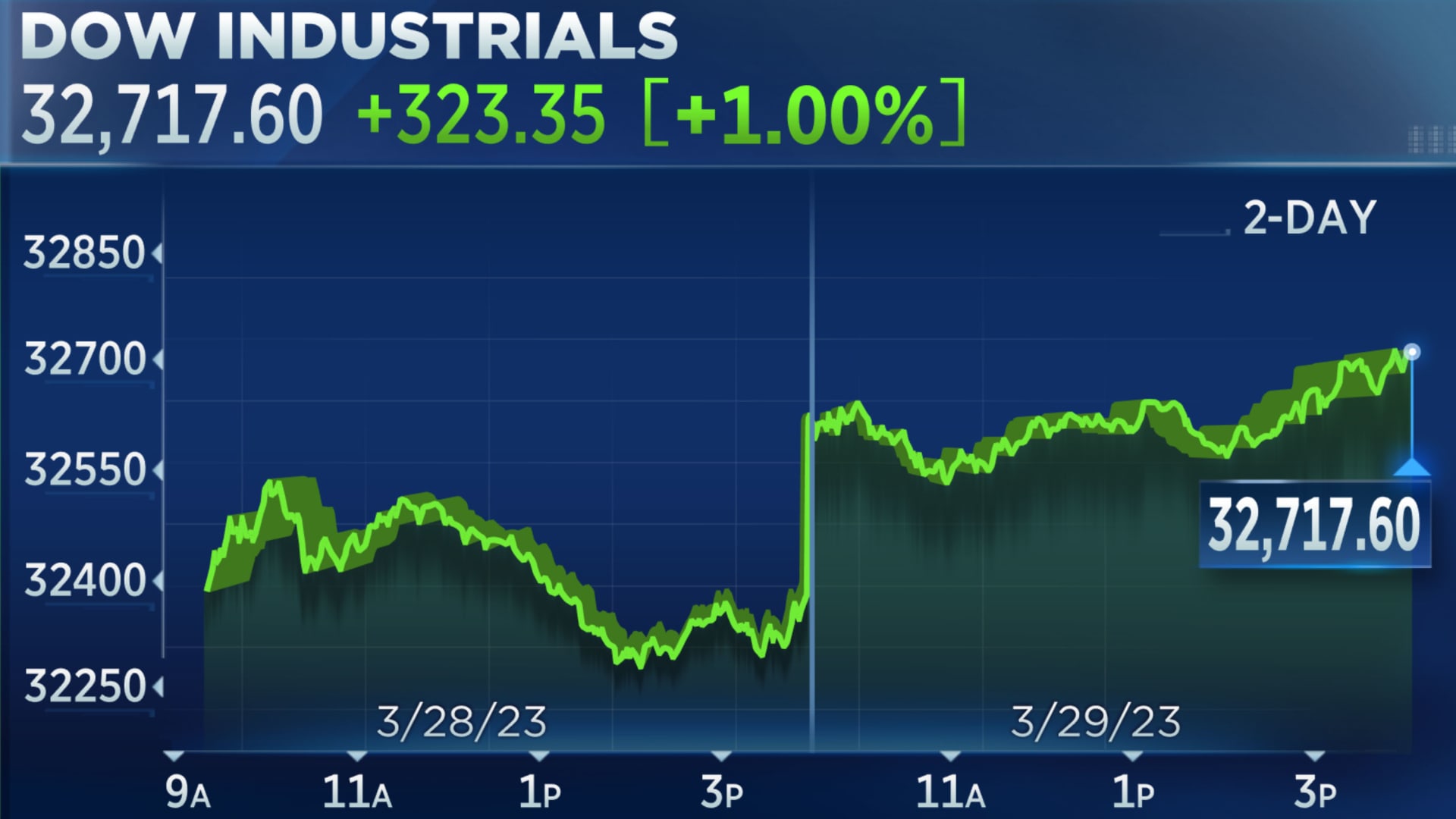

As of October 11, 2023, the major US indices showed mixed results. The S&P 500 gained 0.3%, closing at 4,350, buoyed by better-than-expected earnings reports from several large tech firms. The NASDAQ Composite rose by 0.5%, while the Dow Jones Industrial Average finished with a slight loss of 0.1%. Concerns over inflation and interest rates continue to permeate investor sentiment as the Federal Reserve’s next moves remain uncertain.

Key Events Influencing Markets

Several events have played a significant role in shaping today’s stock market landscape:

- Tech Sector Rally: Leading technology companies reported quarterly earnings that exceeded analysts’ expectations, driving a surge in tech stocks. Companies such as Apple and Microsoft have shown resilience, contributing to confidence in the sector.

- Economic Indicators: Reports indicated an unexpected rise in consumer confidence, which has historically correlated with spending trends. However, retail sales data released earlier this week showed only modest increases, raising concerns about potential consumer slowdown.

- Global Markets: Markets abroad have also shown variability, with Europe facing challenges as energy prices rise ahead of winter. This has created apprehension about economic growth, particularly in the eurozone.

Conclusion and Outlook

Looking ahead, analysts remain cautiously optimistic. The earnings season is expected to continue influencing stock performance as investors assess the implications of corporate health. The forthcoming Federal Reserve meeting will likely be a focal point for traders, as any hints regarding future interest rate adjustments could either support or hinder market momentum. For retail investors, staying informed about these developments and their potential impacts will be crucial in navigating the volatile landscape of stock trading. Maintaining a diversified portfolio could mitigate risks as uncertainty looms on the horizon.