Introduction

The NatWest Group, one of the leading banking and financial services companies in the UK, is closely watched by investors and analysts alike. Its share price is a significant indicator of the bank’s health and overall market sentiment towards banking institutions during these turbulent economic times. Understanding the fluctuations in NatWest’s share price is crucial for both potential investors and stakeholders as they navigate a complicated economic landscape characterized by rising interest rates and inflation.

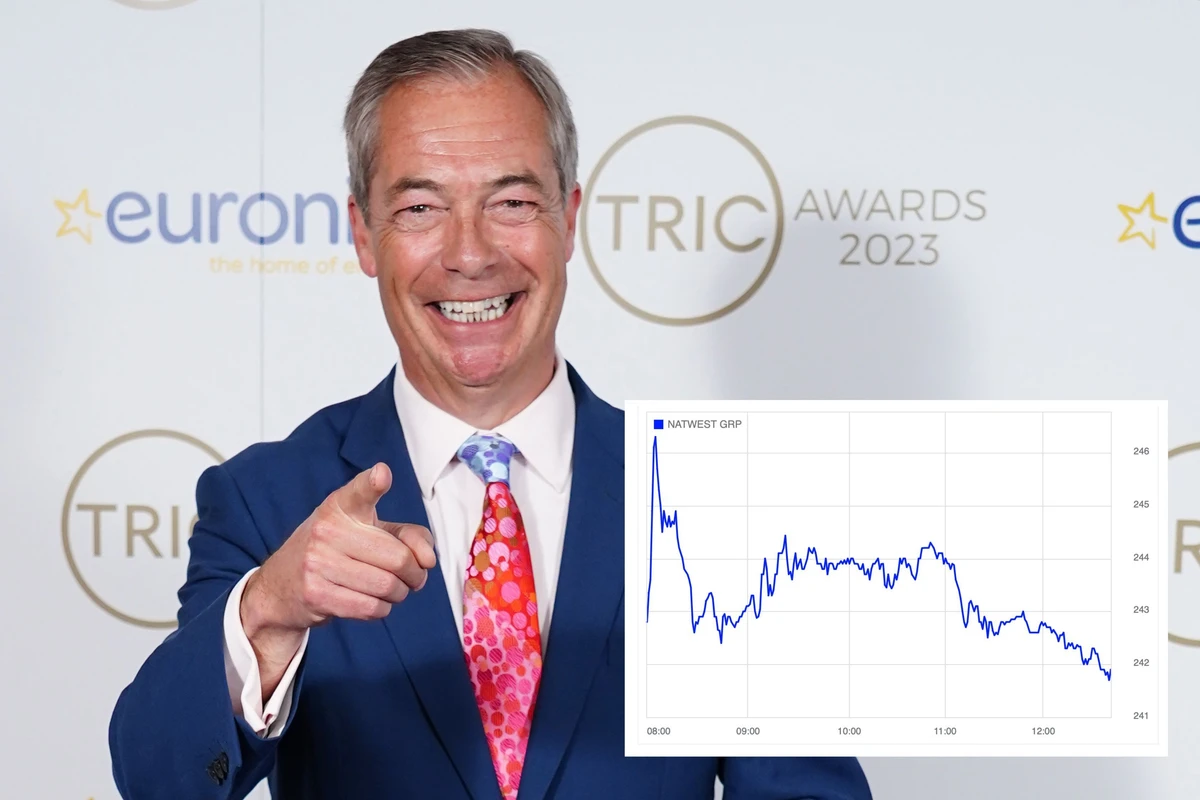

Recent Performance

As of the latest trading session, NatWest’s share price is trading at approximately £3.50, reflecting a slight increase of 1.5% compared to the previous week. Since the onset of 2023, the shares have experienced notable volatility, peaking at £4.00 in May, before tapering off as concerns over rising interest rates began to influence investor sentiment. Analysts have attributed this recent uptick to improved financial results published in the second quarter, which showed a robust profitability gain driven by a surge in net interest margins.

Experts have noted that NatWest’s cautious yet strategic approach to lending during times of economic uncertainty has bolstered investor confidence. The latest earnings report revealed a 15% increase in net profit year-on-year, allowing the bank to resume dividend payments, which had been paused during the pandemic, thereby attracting income-seeking investors.

Market Conditions Influencing Share Price

Several external factors are currently influencing the NatWest share price. The ongoing geopolitical tensions, alongside the Bank of England’s decisions on interest rates, remain key concerns. Recent indications that inflation might persist longer than initially anticipated have led to speculations about further rate hikes, which could impact the attractiveness of bank shares. Furthermore, consumer confidence is notably wavering, impacting loan demand and bank transaction volumes.

Future Outlook

Looking forward, analysts remain cautiously optimistic about NatWest’s share price trajectory. If the bank can continue to manage its risk effectively while capitalising on the higher interest rate environment, its performance may further improve. The consensus among market analysts suggests that NatWest’s share price could see a potential recovery, moving towards the £4.00 mark again if macroeconomic conditions stabilise.

In conclusion, while the NatWest share price shows signs of resilience following strong performance indicators, external economic conditions will continue to play a pivotal role in shaping its future. Investors should remain vigilant and consider both internal banking metrics and broader economic developments while making informed investment decisions.