The Rise of Cryptocurrency Trading

Cryptocurrency trading has gained immense popularity over the past few years, especially with the surge of Bitcoin, Ethereum, and other altcoins. As we step into 2023, the importance of this topic cannot be understated. With millions of individuals globally participating in this digital financial market, understanding trends and strategies has become crucial for both new and seasoned investors.

Current Trends in Cryptocurrency Trading

As of early 2023, the cryptocurrency market has exhibited notable trends. Firstly, decentralised finance (DeFi) has become a significant segment of trading activity, allowing users to lend, borrow, and earn interest on their crypto assets without intermediaries. Moreover, the integration of non-fungible tokens (NFTs) into the trading landscape is reshaping how digital assets are valued and traded.

Another critical trend is the increasing regulatory scrutiny surrounding cryptocurrency exchanges. Governments worldwide are formulating frameworks to address the challenges posed by this burgeoning market. For instance, the Financial Conduct Authority (FCA) in the UK is enhancing its regulations to protect consumers and ensure market integrity.

Recent Developments and Events

In recent months, the cryptocurrency market has experienced notable fluctuations, prompting discussions around market volatility. Following significant downturns in late 2022, Bitcoin has shown signs of recovery, trading above £30,000 as of March 2023. Analysts are observing how macroeconomic factors, such as inflation rates and geopolitical tensions, impact market sentiment and trading volumes.

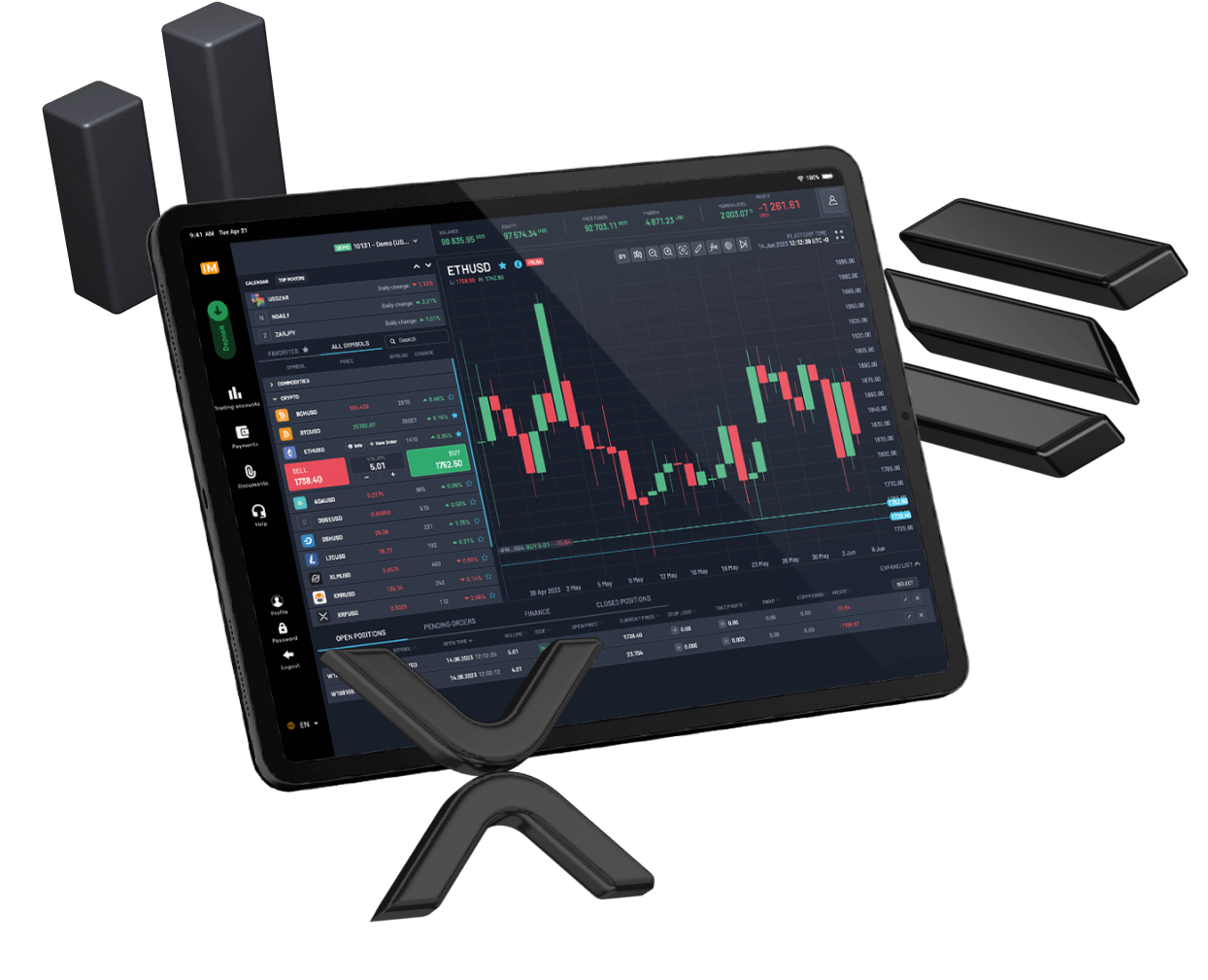

Moreover, trading platforms are continuously evolving, offering new features and enhancements to meet user demands. The introduction of automated trading bots and artificial intelligence-driven trading strategies has made it easier for individuals to navigate the complex landscape, thus attracting more participants into the market.

Conclusion and Future Outlook

As we look ahead, the trajectory of cryptocurrency trading appears promising yet complex. With the potential for higher returns comes an increased need for caution and informed decision-making. Investors must stay abreast of market trends, regulatory developments, and technological advancements to make strategic trading decisions.

The significance of cryptocurrency trading in the evolving financial landscape will likely continue to grow. Therefore, it is essential for market participants to equip themselves with knowledge and tools to thrive in this dynamic environment. In 2023, the mantra for traders will be a mix of innovative strategies and prudent risk management.