Introduction

The rise of Bitcoin has dramatically changed the financial landscape, becoming a critical asset for investors worldwide. As a digital currency, its valuation against the US dollar (USD) is essential for understanding its market behaviour and trends. In recent months, Bitcoin’s price has shown notable volatility, making it a focus for both investors and market analysts.

Current Market Trends

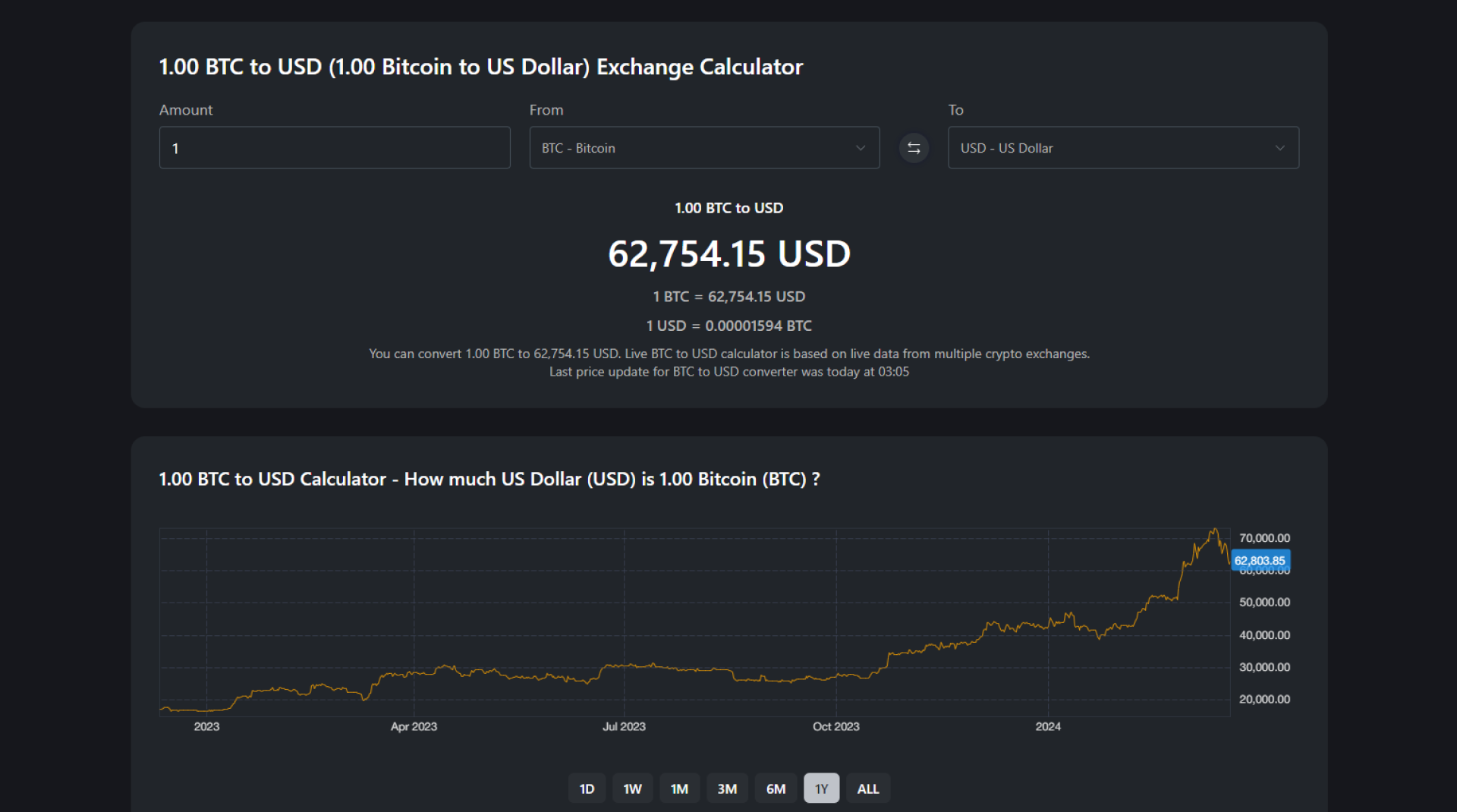

As of October 2023, Bitcoin has experienced significant fluctuations in its value in USD. At the beginning of this month, Bitcoin was trading at approximately $27,000, but by mid-October, it spiked to nearly $32,000, reflecting a surge of over 18% within weeks. This increase is attributed to several factors, including renewed institutional interest and shifting regulatory attitudes toward cryptocurrencies.

On October 15, 2023, the approval of several Bitcoin exchange-traded funds (ETFs) by the US Securities and Exchange Commission (SEC) has added to the currency’s credibility and accessibility, prompting a bullish sentiment among investors. Analyst predictions indicate that if this trend continues, Bitcoin could test resistance levels around $35,000. Historically, Bitcoin tends to rise during the fourth quarter, making the imminent months crucial for price expectations.

Market Sentiment and Future Outlook

The market sentiment surrounding Bitcoin remains cautiously optimistic. Despite regulatory challenges and market corrections inherent to cryptocurrencies, the growing institutional adoption reflects increased confidence in Bitcoin as a legitimate asset class. This transformation in perception could stabilise its pricing against the USD and reduce volatility over the long term.

Experts suggest that investors should closely monitor global economic conditions, as inflation rates and currency devaluations may influence Bitcoin’s price dynamics against the USD. Furthermore, advancements in blockchain technology and the broader cryptocurrency ecosystem are likely to play significant roles in Bitcoin’s future value.

Conclusion

In conclusion, Bitcoin’s performance against the USD remains a critical indicator of its broader market health. The current trends demonstrate a complex interplay of market forces, investor behaviour, and external economic conditions. For potential investors, understanding these dynamics is vital for making informed decisions in an ever-evolving landscape. As we progress towards the end of the year, all eyes will be on Bitcoin and its capacity to sustain gains, indicating its place in the future of finance.