Introduction

The Shell share price is a critical indicator for investors and analysts within the energy sector, reflecting the company’s performance and market conditions. Following the recent fluctuations in the global oil market, understanding the factors that impact Shell’s stock is more important than ever for potential and current investors.

Recent Developments

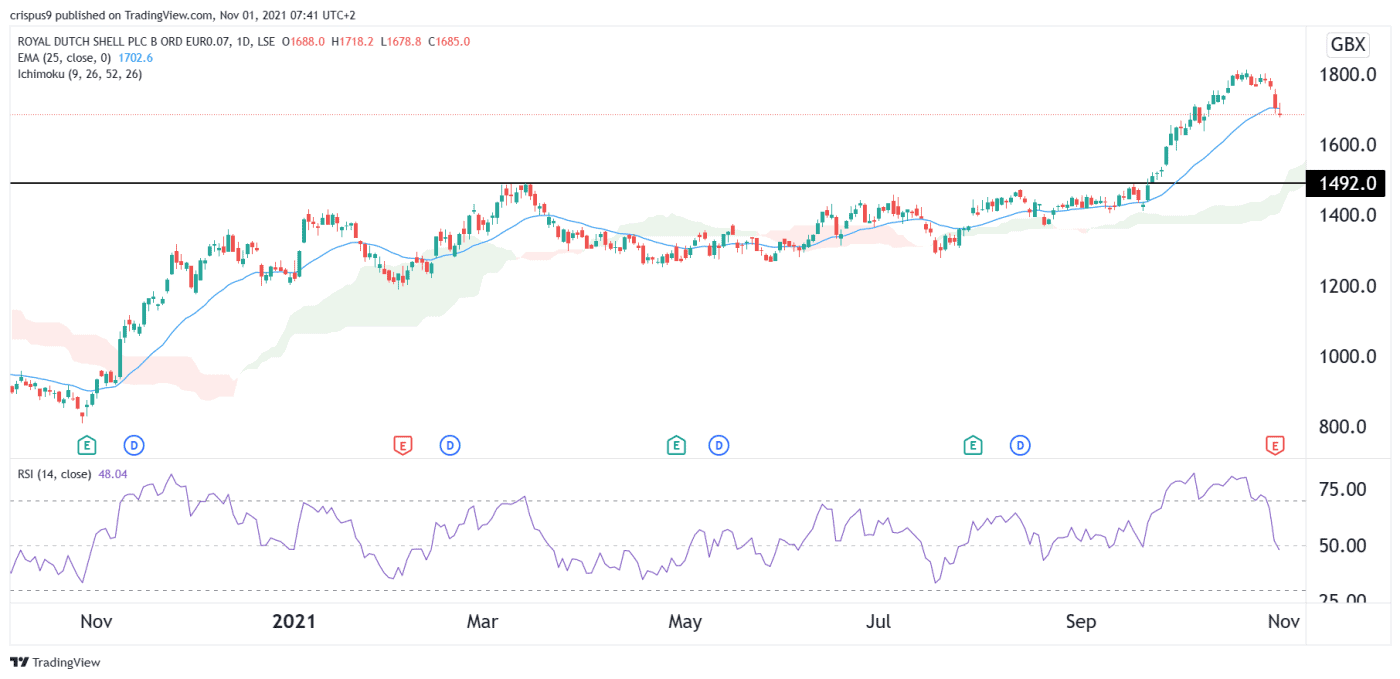

As of October 2023, Shell’s share price has witnessed a noticeable change, with the stock trading around £21.50, marking an increase of nearly 5% over the past month. This uptick follows positive earnings reports that highlighted the company’s strong performance in the third quarter, despite ongoing challenges posed by volatile oil prices and geopolitical tensions.

Additionally, Shell has been increasingly focusing on its renewable energy initiatives alongside its traditional oil and gas operations. This dual approach aims to mitigate risks associated with fossil fuels and appeal to environmentally-conscious investors, which is demonstrating a potential uplift in share price as market sentiments shift towards sustainable investments.

Factors Influencing Shell Share Price

Several factors play a crucial role in influencing the Shell share price:

- Global Oil Prices: The fluctuations in crude oil prices directly correlate with Shell’s revenues, affecting investor sentiment and stock value.

- Regulatory Changes: Policies targeting carbon emissions and renewable energy adoption can also pressure traditional energy companies, including Shell, impacting their share valuations.

- Market Sentiment: Investor confidence can sway substantially with news related to Shell’s operations, acquisitions, or regulatory compliance, further influencing share price movements.

- Financial Performance: Quarterly earnings reports and dividends can significantly affect stock prices, especially if results exceed or fall short of market expectations.

Conclusion

In conclusion, the Shell share price is currently benefiting from a combination of positive earnings results and the company’s strategic shift towards renewable energy. However, external factors, such as crude oil price volatility and regulatory pressures, continue to pose risks. Investors are advised to stay informed about global energy trends and Shell’s strategic decisions that could impact the company’s future market performance. As the energy landscape evolves, Shell’s adaptation will be crucial, making its share price a focal point for investment discussions moving forward.