The Importance of Bitcoin and USD

Bitcoin, the leading cryptocurrency, continues to capture the attention of investors and the financial community due to its volatility and potential for significant returns. Its conversion to USD not only reflects its value but also serves as a benchmark for assessing the broader cryptocurrency market. As of October 2023, Bitcoin’s fluctuating price dynamics make it a focal point for both new and seasoned investors.

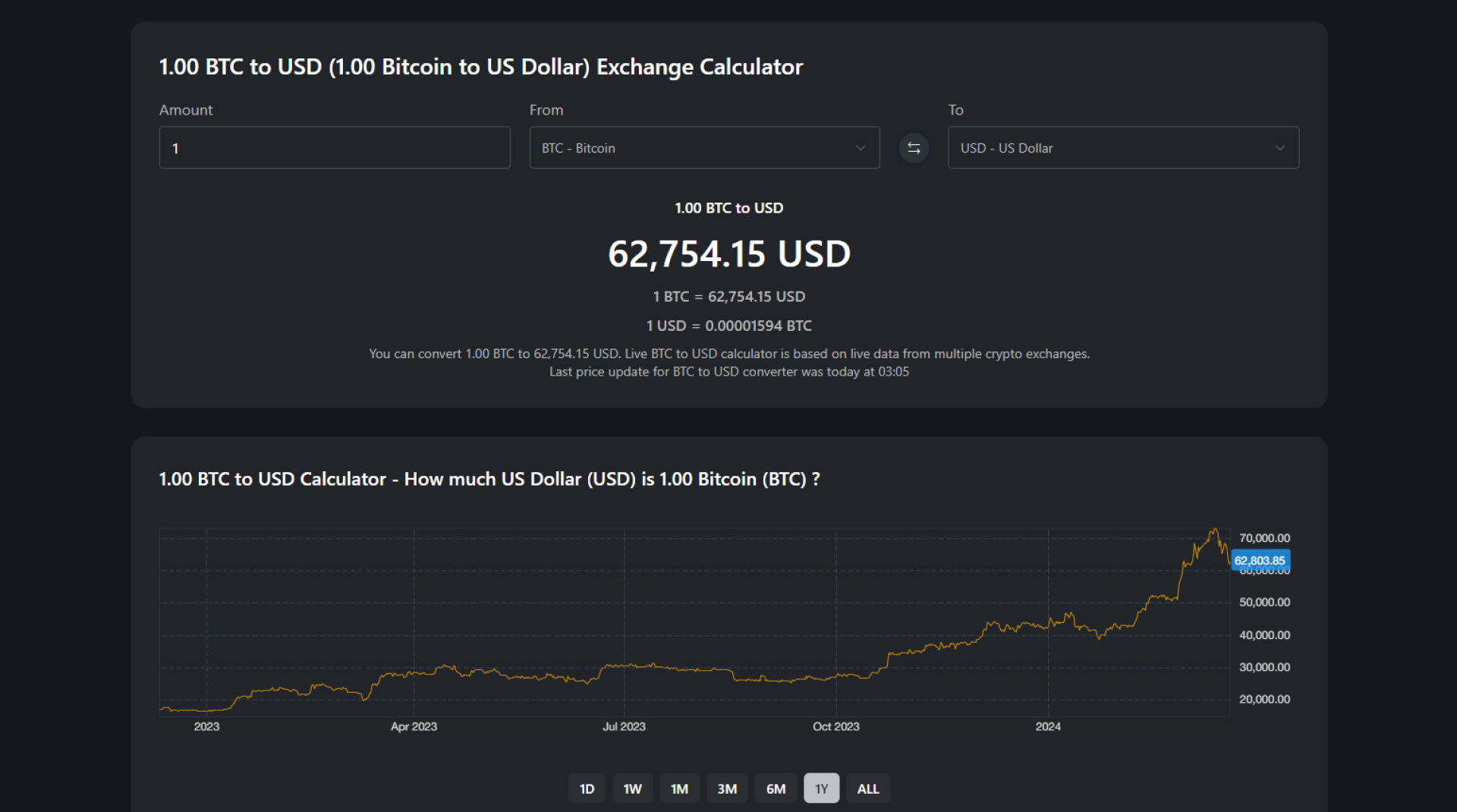

Current Trends in Bitcoin to USD

Recently, Bitcoin has seen a notable rise in its value, approaching the $40,000 mark, driven by increasing institutional adoption and regulatory clarity in various markets. According to data from CoinMarketCap, Bitcoin’s price has experienced an average increase of 15% over the past month, with significant buying interest following announcements from major companies accepting Bitcoin as a form of payment.

The USD remains a pivotal currency for Bitcoin transactions, acting as a primary exchange medium. This relationship underscores the importance of monitoring the USD’s performance against traditional assets, including stocks and commodities, as shifts often influence Bitcoin’s valuation. Analysts have observed that a robust USD tends to correlate with downward pressure on Bitcoin prices, while a weaker USD can lead to increased demand for digital assets.

Factors Influencing Bitcoin’s Value

Several factors currently affect Bitcoin’s exchange rate with the USD. These include the macroeconomic environment, regulatory developments, and market sentiment. For instance, the recent interest rate hikes by the Federal Reserve have prompted investors to reconsider their asset allocations, leading to a cautious outlook on cryptocurrencies. Regulatory developments, especially in Europe and Asia, also play a critical role in shaping investor confidence and market trends.

Conclusion and Future Outlook

As Bitcoin continues to navigate its inherent volatility, the relationship between Bitcoin and USD remains crucial for understanding the cryptocurrency landscape. Investors must remain vigilant and informed about market fluctuations, regulatory news, and macroeconomic indicators. Forecasts suggest that should Bitcoin break previously established resistance levels above $40,000, we may see new institutional investments pouring in, which could further elevate its standing against the USD. For readers exploring investment opportunities in Bitcoin, staying updated with these trends and market sentiment is vital.