Introduction

Student finance is a crucial aspect of higher education in the UK, influencing the choices and experiences of thousands of students each year. With tuition fees rising, understanding the options available for funding is more important than ever for prospective and current students. This article aims to outline student finance options, their impacts, and what students should consider when planning their education.

Current Landscape of Student Finance

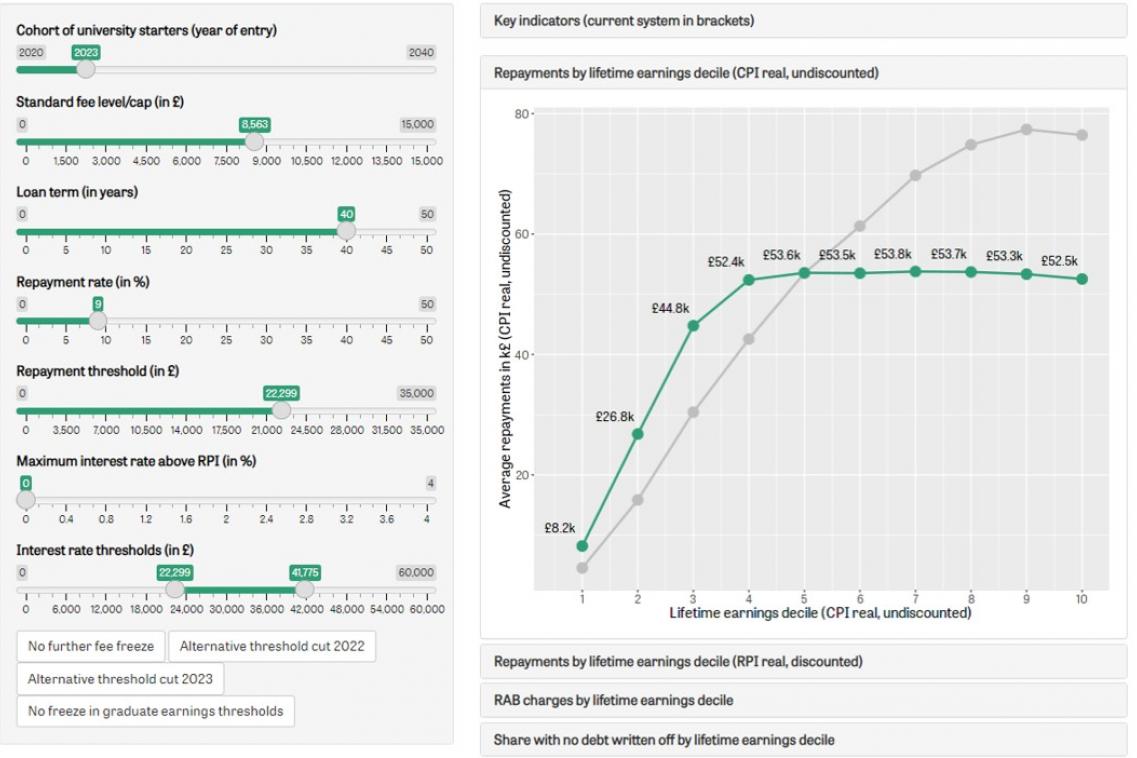

As of the 2023 academic year, tuition fees for undergraduate courses in England can reach up to £9,250 per year. This significant financial commitment often necessitates loans, which are available through the Student Loans Company (SLC). The SLC provides two main forms of financial support: tuition fee loans, which cover the cost of tuition upfront, and maintenance loans, which help students with living expenses.

Recent data indicates that approximately 60% of UK students rely on student loans for their education financing. The total amount of outstanding student debt in the UK has surpassed £200 billion, bringing attention to the long-term ramifications of such borrowing. With interest rates currently on student loans set at inflation plus 3%, many graduates face the prospect of repaying their loans for several decades.

Grants and Scholarships

In addition to loans, students can explore various grants and scholarships that can lessen the financial burden. For instance, the Maintenance Grant, which was available to students from low-income households, has been scrapped; however, institutions and charitable organisations offer scholarships based on merit, financial need, or specific criteria such as ethnicity or disability.

Future Financial Implications

Looking ahead, the impact of student finance extends beyond graduation, affecting students’ long-term financial health. According to recent surveys, graduates typically earn higher salaries than non-graduates, but the student debt associated with their education can significantly influence their financial decisions post-graduation. The prospect of high monthly repayments can deter young adults from purchasing homes or pursuing further education.

Conclusion

In conclusion, student finance in the UK remains a pivotal aspect of the educational landscape. As tuition fees continue to rise and the cost of living increases, understanding the full spectrum of financial options available, including loans, grants, and scholarships, is essential for students embarking on their higher education journey. Looking into the future, it is crucial for policymakers to consider how changes in student finance structures will affect upcoming generations, ensuring that higher education remains accessible and not a source of long-term financial distress for graduates.