Introduction

The S&P 500, or Standard & Poor’s 500, is a vital stock market index that encapsulates the performance of 500 of the largest companies listed on stock exchanges in the United States. It serves as a benchmark for the overall health of the U.S. equities market and is widely used by investors as a gauge of economic performance. Given the current fluctuations in the market and the ongoing recovery from the pandemic, understanding the S&P 500 is more critical than ever.

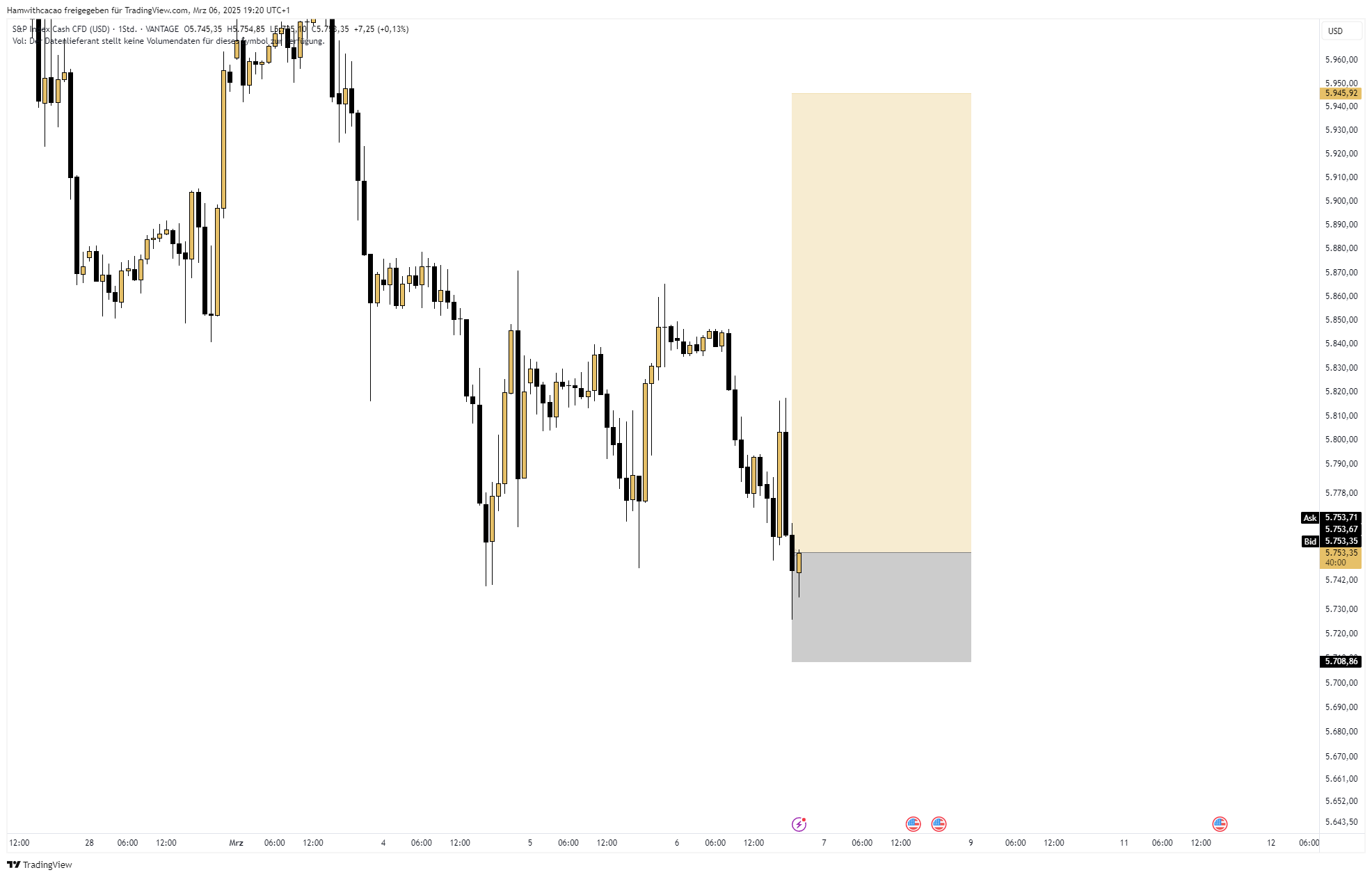

Recent Performance Trends

As of October 2023, the S&P 500 index has demonstrated notable resilience, recovering from earlier market downturns caused by factors such as high inflation and interest rate hikes. Over the past few months, the index has posted a series of gains, inspired by strong quarterly earnings reports from leading technology companies and a better-than-expected job market report. Analysts indicate that the index surpassed 4,400 points, reflecting a significant rebound from its previous lows.

Positive performance highlights include companies like Apple and Microsoft, which reported record sales and maintained robust forecasts despite global challenges. Energy stocks have also performed admirably, benefitting from ongoing shifts towards renewable resources and fluctuating oil prices.

Key Economic Indicators

Several economic indicators continue to influence the S&P 500, including the Federal Reserve’s stance on interest rates and inflation control strategies. The Fed’s recent decision to pause rate hikes has provided a boost of confidence in the market, encouraging investment in equities. Furthermore, the unemployment rate remains low, hinting at a resilient labour market that supports consumer spending, further lifting the index.

Future Outlook

Looking ahead, experts remain cautious yet optimistic about the S&P 500’s trajectory. While there are ongoing concerns regarding potential recession signals and geopolitical tensions, many believe that strong corporate earnings could help sustain the upward momentum of the index. Investor sentiment remains vigilant as they keep a close eye on upcoming economic data releases, which will play a significant role in shaping market expectations.

Conclusion

The S&P 500 continues to serve as a barometer for financial health and investor sentiment in the U.S. As market dynamics evolve, understanding the factors influencing this key index will be crucial for investors looking to navigate the current economic landscape. Whether through tracking corporate earnings or observing macroeconomic trends, the S&P 500’s significance cannot be understated in today’s investment climate.