Introduction to the Lifetime ISA

The Lifetime Individual Savings Account (ISA) has emerged as a significant financial tool for young savers in the UK, particularly those looking to purchase their first home or save for retirement. Launched in 2017, the aim of this account is to encourage saving by providing government bonuses, making it a critical asset for first-time buyers and long-term investors.

Key Features of the Lifetime ISA

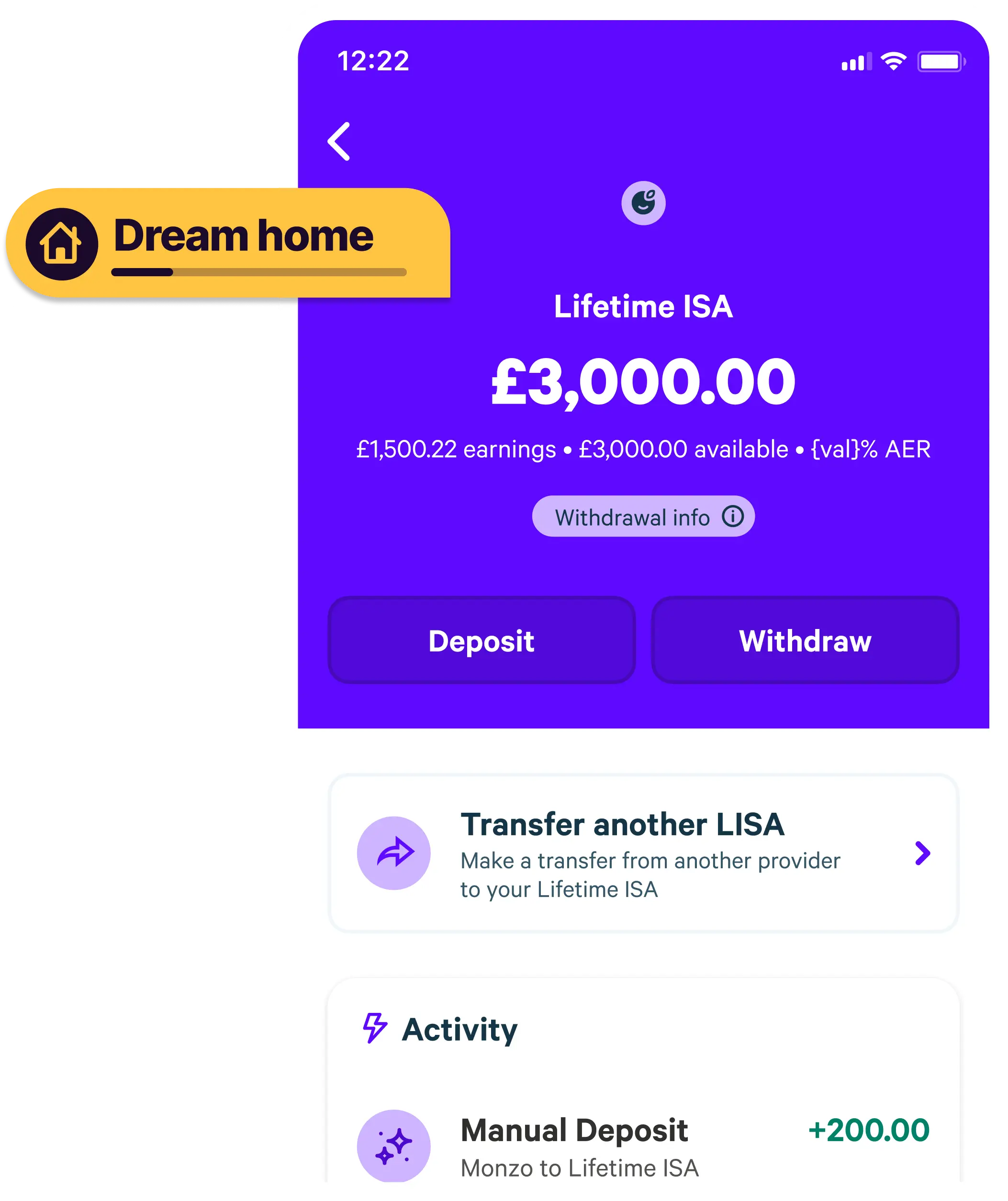

The Lifetime ISA allows individuals aged 18 to 39 to save up to £4,000 each tax year, with the government contributing a bonus of 25% on top of the savings. This means that savers can receive up to £1,000 in bonuses per year, significantly boosting their savings. The funds can be accessed tax-free to purchase a first home costing up to £450,000 or can be withdrawn for retirement after age 60.

Recent Developments and Statistics

Recent figures from HM Revenue and Customs (HMRC) show that approximately £1.1 billion has been paid out in bonuses to Lifetime ISA holders since its introduction. As of the end of the last tax year, over 800,000 accounts had been opened, reflecting a growing interest in this savings vehicle. Particularly notable is the increasing number of young people using the Lifetime ISA as a stepping stone towards home ownership in the shadow of a challenging housing market.

Challenges and Considerations

However, savers considering a Lifetime ISA must be aware of certain restrictions. The bonus applies only if the funds are used for a first home or retirement, and any other withdrawals may incur a 25% penalty. Additionally, the Lifetime ISA is just one of several savings options available, so it’s important for individuals to assess whether it aligns with their financial goals and circumstances.

Conclusion: The Future of Lifetime ISAs

As the UK housing market continues to present challenges for first-time buyers, the Lifetime ISA stands as a valuable proposition for many young savers. With ongoing financial education and awareness, its popularity is expected to grow, playing an essential role in helping individuals build a secure future. For those considering using a Lifetime ISA, it is crucial to stay informed about the rules and maximise the benefits of this innovative savings account.