Introduction

The Federal Reserve, commonly referred to as the Fed, plays a crucial role in the United States economy. Established in 1913, it serves as the central bank of the country, aiming to provide the nation with a safer, more flexible, and more stable monetary and financial system. Given the recent economic fluctuations and inflation concerns, understanding the functions and decisions of the Fed have become increasingly pertinent for individuals, businesses, and policymakers alike.

Monetary Policy Decisions

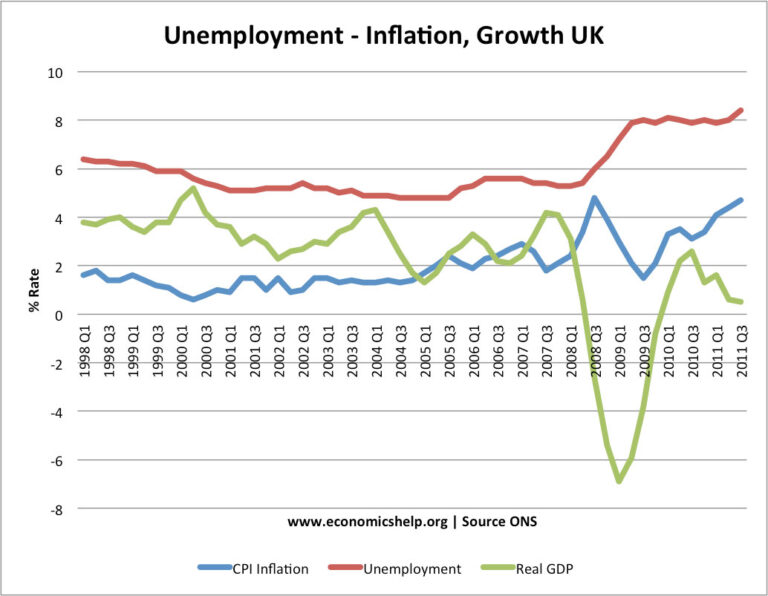

In 2023, the Fed has been tasked with navigating the delicate balance between fostering economic growth and controlling inflation, which has surged to levels not seen in decades. The most impactful tool at the Fed’s disposal is its ability to adjust interest rates. In recent months, the Federal Open Market Committee (FOMC) has raised the benchmark interest rate several times in response to persistent inflationary pressures. As of October 2023, the interest rate stands at a range of 5.25%-5.50%, a significant increase from the historical lows during the pandemic.

Impact on Consumers and Businesses

The Fed’s decisions directly influence the borrowing costs for consumers and businesses alike. Higher interest rates typically lead to increased costs for loans, affecting mortgages, credit cards, and business financing. While this may help temper inflation, it can also slow economic growth, leading to concerns about a potential recession. Recent surveys have shown that small businesses are hesitant to invest due to uncertainty surrounding borrowing costs, demonstrating how the Fed’s actions resonate throughout the economy.

Outlook and Significance

Looking forward, many economists predict that the Fed will continue to monitor economic indicators closely while making gradual adjustments to policy. The central bank’s dual mandate—to promote maximum employment and stable prices—remains a guiding principle. The Fed’s upcoming meetings will be pivotal, possibly indicating a shift in strategy based on the evolving economic landscape. For readers, staying informed about these developments is essential, as the Fed’s policies will ultimately shape the economic climate, influencing everything from personal savings to global markets.

Conclusion

In conclusion, the Federal Reserve’s role is a cornerstone of economic stability and growth in the United States. Its ongoing efforts to manage inflation and support recovery highlight the complexities of financial governance. As the next Federal Open Market Committee meeting approaches, the Fed’s choices will be crucial in determining the economic path forward, making it imperative for individuals and businesses to remain vigilant about these vital developments.