The Importance of Barclays Share Price

The Barclays share price is a critical indicator not only of the bank’s financial health but also of the larger economic climate within the UK. As one of the major players in the banking sector, fluctuations in its share price can have ripple effects across various markets. Investors and analysts routinely monitor these changes to gauge the bank’s performance, forecasts, and the overall economic trends in the finance sector.

Recent Developments

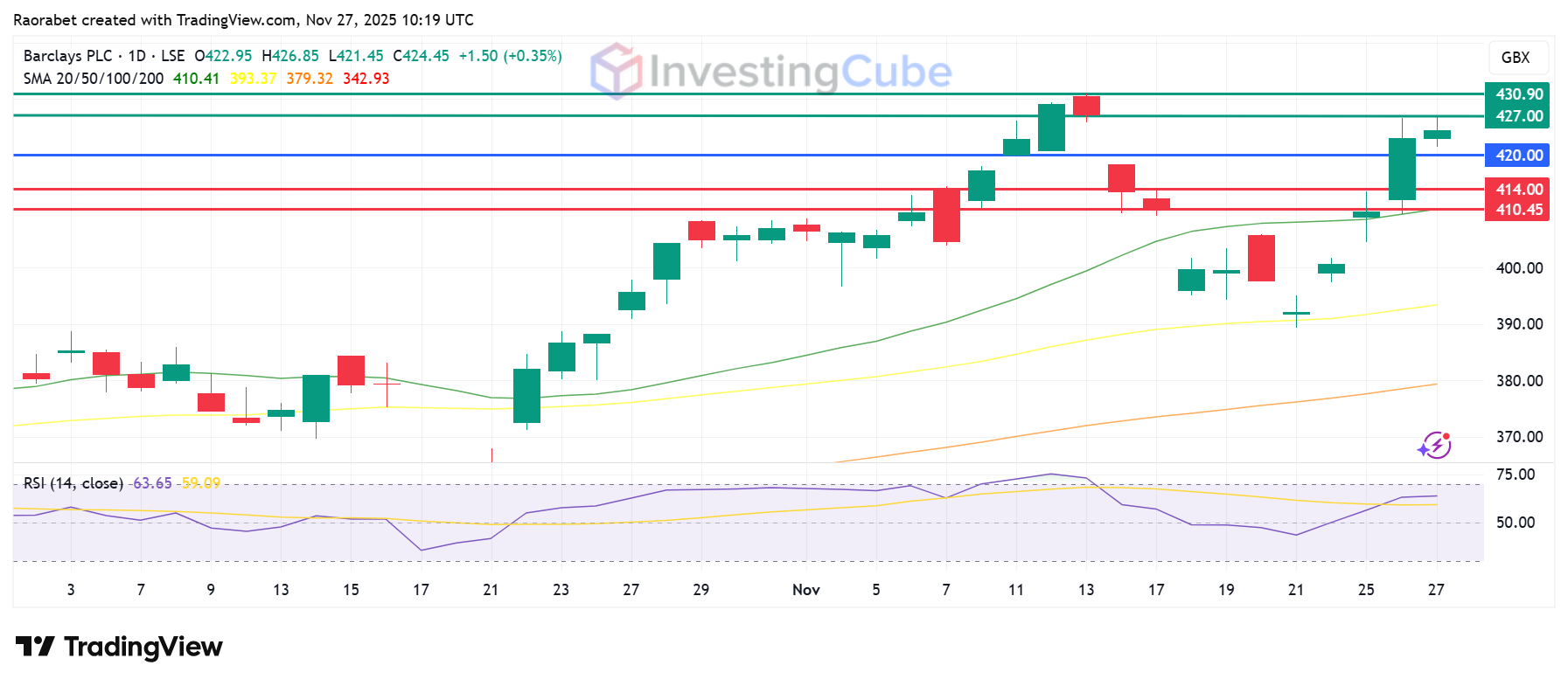

As of October 2023, Barclays has experienced notable volatility in its share price, reflecting the broader uncertainties in global markets, including inflationary pressures and shifting interest rates. Earlier this month, the share price reached a peak of 211.00p but has since pulled back slightly due to a mixed response to the latest monetary policy from the Bank of England.

Analysts report that market sentiment has been influenced by a range of factors including geopolitical tensions, particularly surrounding energy prices which tend to affect banking operations and profitability margins. Despite these challenges, Barclays reported a quarterly earnings increase which suggests that the bank is navigating these turbulent waters with relative resilience.

Investor Sentiment and Forecasts

Current investor sentiment towards Barclays has been cautiously optimistic. While some market analysts express concern about potential recessionary scenarios in the UK, others believe that Barclays is well-positioned to adapt to changing market conditions given its diversified business model and recent strategic initiatives. The bank’s focus on digital banking and cost-effective operations continues to play a significant role in its long-term outlook.

Market analysts have set a price target of approximately 220.00p for the upcoming quarter, contingent on stabilising economic indicators and the bank’s ability to control operating costs amidst ongoing inflation. As fiscal policies evolve and the economic landscape shifts, investors are advised to stay informed about both Barclays’ performance and external economic factors which could influence its stock price.

Conclusion

The Barclays share price serves as a vital barometer for the UK banking sector amid challenging economic conditions. With current fluctuations reflecting broader market uncertainties, investors are encouraged to monitor upcoming earnings reports and economic indicators. As Barclays continues to adapt to the changing environment, its share price will likely remain an area of significant interest for both investors and analysts alike, ultimately shaping the outlook for the bank in the months to come.