Introduction

Mortgage rates today are pivotal for prospective homebuyers, current homeowners looking to refinance, and investors alike. With changes in the economy, interest rates have become a hot topic as they directly influence the affordability of purchasing property. Understanding the current landscape of mortgage rates can help consumers make informed decisions regarding their financial futures.

Current Mortgage Rate Trends

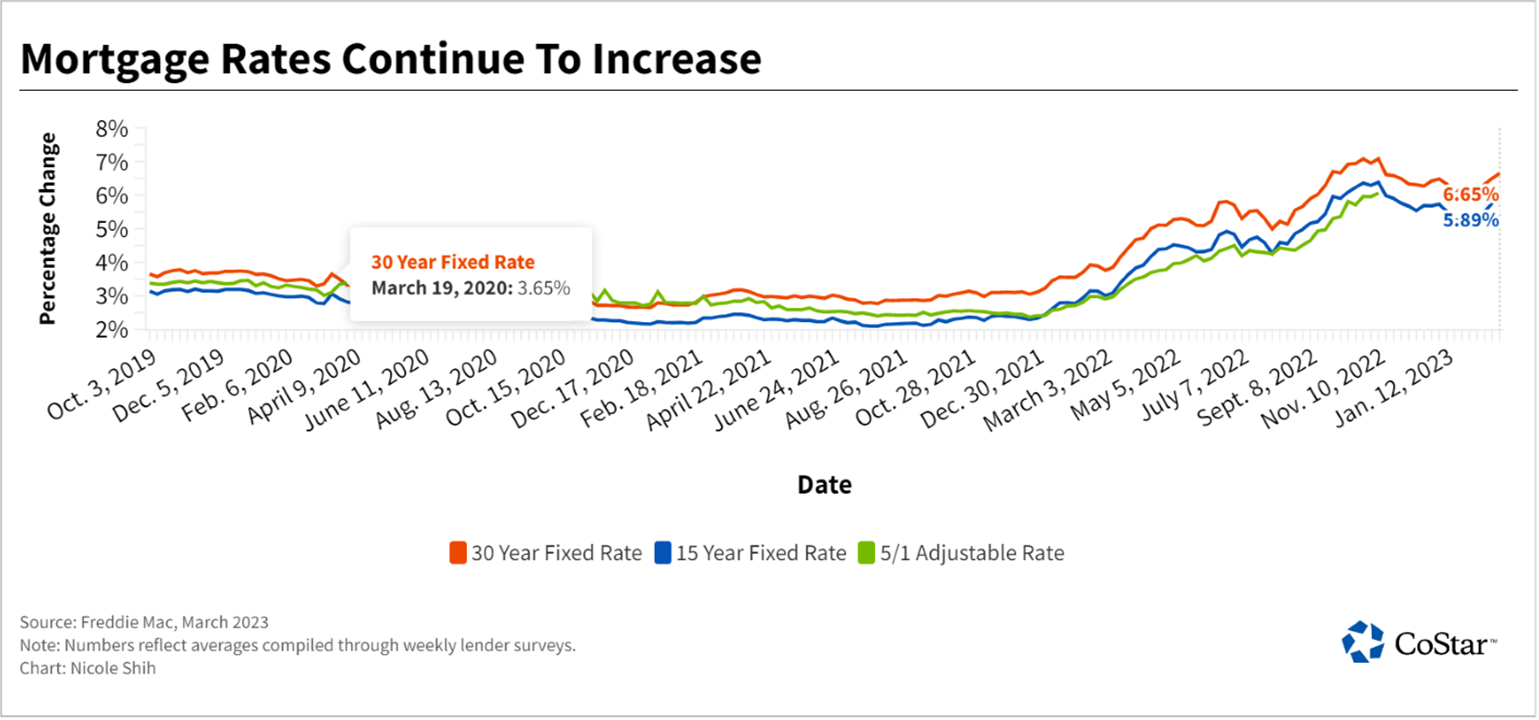

As of mid-October 2023, mortgage rates have been fluctuating due to various economic factors, with the average rate for a 30-year fixed mortgage hovering around 7.1%, according to the latest data from Freddie Mac. This represents a notable increase compared to the previous year, where rates averaged around 3.09% in late 2021. The rise in mortgage rates is largely attributed to the Federal Reserve’s ongoing measures to combat inflation, which has seen rates climb sharply over the past year.

Factors Influencing Mortgage Rates

The trajectory of mortgage rates is influenced by multiple factors including economic growth, inflation rates, and the Federal Reserve’s monetary policy. In addition, geopolitical events and disruptions in supply chains also affect the housing market and interest rates. Analysts predict that if inflation continues to remain high, the Fed may implement further rate hikes in the coming months, which could push mortgage rates even higher.

Impact on Homebuyers and the Housing Market

The increase in mortgage rates has had widespread effects on the housing market. Many potential buyers are finding it increasingly difficult to qualify for loans or afford new homes due to higher monthly payments. According to a report from the National Association of Realtors, the number of home sales has decreased, reflecting the hesitance among buyers faced with increased borrowing costs. On the other hand, higher rates may lead to less competition among buyers, potentially allowing some to negotiate better deals.

Conclusion

For anyone interested in purchasing a home, keeping an eye on mortgage rates today is crucial. As the economic landscape evolves, so do the prospects for borrowing. Homebuyers should consider getting pre-approved for loans, and explore various lenders to find the best rates available. As forecasts suggest, potential future increases could further elevate rates, making it essential for buyers to act sooner rather than later to maximise their opportunities in a shifting market.