Introduction

The Scottish budget income tax changes announced in the recent financial statement by the Scottish Government have stirred discussions across the nation. With alterations to the tax thresholds and rates, these adjustments aim to provide a fairer taxation system while also addressing the economic challenges faced by residents amidst inflation and rising living costs.

Details of the Changes

In the 2023-2024 budget, Finance Secretary Kate Forbes outlined several key changes that will impact Scotland’s taxpayers. The changes focus on adjusting tax bands, where the threshold for the 41% rate of tax has been lowered from £50,270 to £49,000. This means that those earning above £49,000 will now pay a higher percentage of their income in taxes, which the government argues is necessary to fund public services.

Additionally, the basic rate band remains unchanged, with taxable earnings under £25,000 still subject to a 19% tax rate. Critics, however, have expressed concerns regarding the potential consequences on middle-income earners, who may struggle with increased financial burdens due to these changes.

Impact on Taxpayers

According to recent data from the Scottish Fiscal Commission, nearly one-third of taxpayers in Scotland are expected to be affected by these changes. The commission estimates that the adjustments could raise an additional £400 million in revenue for the Scottish Government, which is intended to be invested in public services such as healthcare and education.

However, public reaction has been mixed. While some commend the government for taking steps to ensure wealthier individuals contribute more, others caution that this could lead to an exodus of skilled professionals and high earners seeking more favourable tax environments. The call for progressive taxation continues, as many Scots advocate for a system that does not disproportionately impact those in the middle-income bracket.

Conclusion

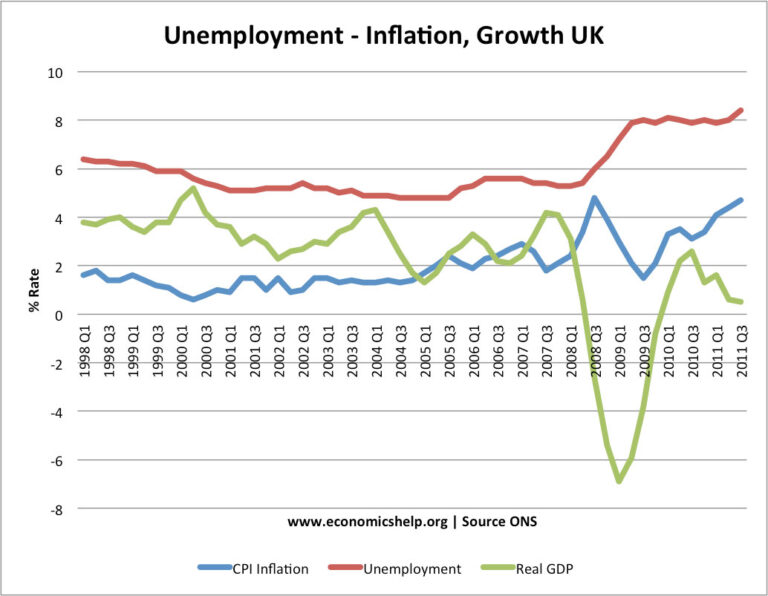

As debates continue over these income tax changes, the implications for Scotland’s economy remain to be fully realised. Moving forward, it will be crucial to monitor both the economic outcomes and public sentiment surrounding these reforms. Predictions suggest a period of adjustment ahead, with potential implications for employment levels and financial stability for average taxpayers. The Scottish Government’s approach to balancing fiscal responsibility while supporting citizens will likely remain a key topic of discussion leading into future budgets.