Introduction to Government Borrowing

Government borrowing is a critical aspect of economic policy that impacts fiscal health, public investment, and financial stability. It refers to the practice of a government borrowing funds to cover budget deficits or to finance public projects. In recent times, particularly following the global pandemic, government borrowing has surged, raising crucial questions about economic sustainability and future fiscal policy. Understanding its implications is vital for both policymakers and citizens alike.

Current Landscape of Government Borrowing

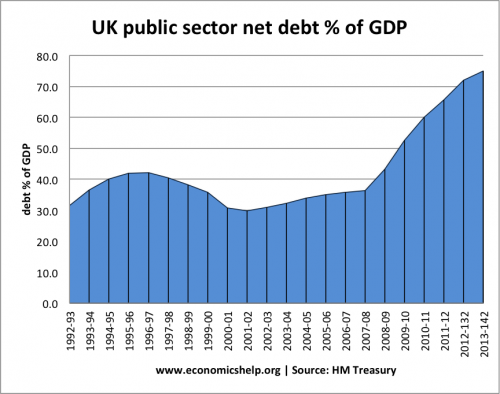

As of 2023, the UK government’s borrowing has been a hot topic of discussion amidst rising inflation and fluctuating interest rates. According to the Office for National Statistics (ONS), the government’s net borrowing for the financial year 2022-2023 reached £130 billion, which equals about 5.6% of the GDP. This borrowing was significantly influenced by ongoing expenditures aimed at stimulating the economy and addressing the aftermath of the pandemic.

Recent policies such as the Support for Energy Costs scheme have also required substantial government funds, highlighting the balancing act between providing support and maintaining public debt. As interest rates rise under the Bank of England’s current monetary policy, the cost of servicing this debt is expected to increase, creating further implications for future budgets.

Implications of High Government Borrowing

High levels of government borrowing can lead to potential consequences for economic growth. While it can enable investment in vital public services and infrastructure, excessive borrowing can strain future budgets through increased debt repayments. Economists warn that relying on debt financing can suppress economic growth in the long term if not managed carefully. Additionally, concerns about inflation and rising interest rates may lead to higher taxes or cuts in public spending to control borrowing in the future.

Conclusion and Future Outlook

As government borrowing continues to be a critical aspect of UK fiscal policy, its implications will remain relevant for citizens and businesses alike. The government is tasked with the challenge of balancing the need for immediate economic support with the necessity of long-term fiscal sustainability. The upcoming budget proposals, expected later in the year, will shed further light on how the UK government plans to navigate this complex landscape. Public awareness and understanding of government borrowing will be crucial as decisions made today will shape economic conditions for years to come.