Introduction

Interest rates are a critical tool used by the Federal Reserve (Fed) to regulate economic activity in the United States. Their decisions have far-reaching effects on various sectors, from housing to consumer spending. Recently, the Fed’s adjustments in interest rates have sparked discussions about inflation, economic growth, and the overall health of the economy, making this topic particularly relevant as financial experts and citizens alike analyse its implications.

The Current Landscape of Interest Rates

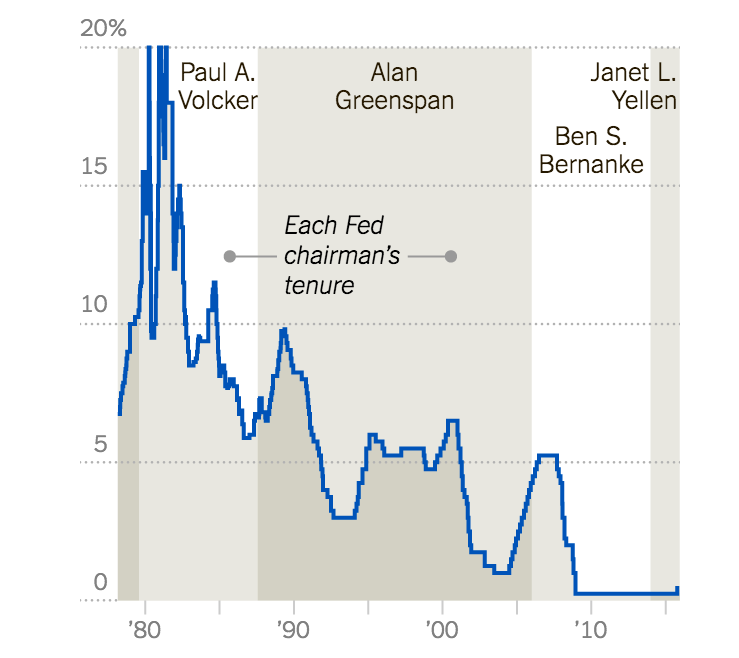

As of November 2023, the Federal Reserve has maintained interest rates in a targeted range of 5.25% to 5.50%. This decision comes after a series of rate hikes aimed at combating persistent inflation that averaged around 3.7% year-on-year throughout the latter half of 2023. In September, the Fed held its rate steady, signalling a cautious approach amid mixed economic signals, including labour market resilience and ongoing inflation pressures.

The Fed’s Decision-Making Process

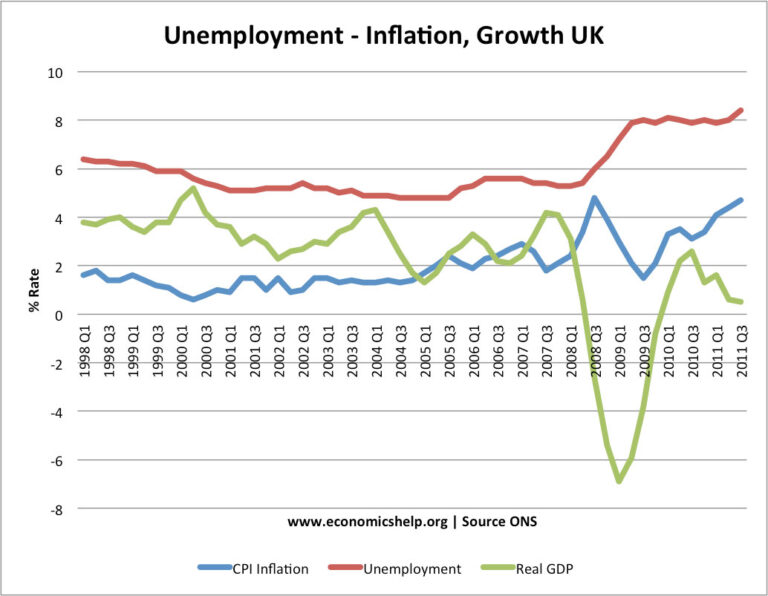

The Fed uses interest rates to influence economic conditions. Higher rates typically slow down borrowing and spending, which can help reduce inflation. Conversely, lower rates encourage borrowing and can stimulate economic growth. The Federal Open Market Committee (FOMC), which meets regularly to deliberate on these decisions, considers various economic indicators including unemployment levels, consumer confidence, and inflationary trends when setting interest rates.

Market Reactions and Future Predictions

Following the Fed’s latest announcements, financial markets have exhibited a mixed response. Stock markets have fluctuated as investors weigh the implications of sustained high-interest rates on corporate profits and economic growth. Analysts predict that if inflation does not cool significantly in the coming months, the Fed may opt for further rate adjustments. Some experts warn of a potential recession if these rates remain elevated for an extended period, impacting consumer spending and business investment.

Conclusion

The Federal Reserve’s approach to interest rates is a significant part of economic policymaking in the U.S., reflecting ongoing battles against inflation while trying to foster growth. As the economy navigates these choppy waters, understanding the implications of the Fed’s decisions on interest rates is crucial for consumers and investors. Going forward, all eyes will be on the Fed as further announcements may herald pivotal changes in economic directions, especially if inflation continues to be a pressing concern.