Introduction

The triple lock state pension increase is a crucial policy for millions of pensioners in the UK, ensuring their pensions remain fair and sustainable in the face of rising living costs. With the ever-increasing pressures from inflation and fluctuating wage growth, the triple lock system serves to protect the financial stability of the elderly, providing them with an assurance that their state pensions will not diminish in value over time.

What is the Triple Lock?

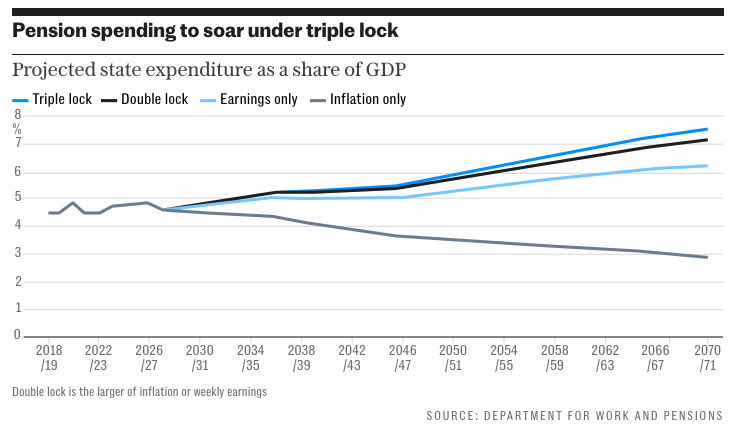

Introduced in 2010, the triple lock policy guarantees that the state pension in the UK will increase each year by the highest of three measures: inflation, average wage growth, or a minimum of 2.5%. This approach was designed to ensure that pensioners benefit from economic growth while also safeguarding their income against inflation.

Recent Developments

In recent months, the issue of the triple lock state pension has stirred considerable debate, especially with inflation reaching unprecedented levels. Recent reports indicate that inflation could influence the state pension increase significantly in April 2024. Currently, inflation remains above 5%, which would activate the inflation measure of the triple lock, raising pensions by a significant amount compared to previous years.

Government officials have acknowledged the rising costs of living that affect retirees, which is prompting discussions on the sustainability of the triple lock. The Chancellor is under pressure to honour the commitment while balancing the broader implications for public spending and taxation.

Implications for Pensioners

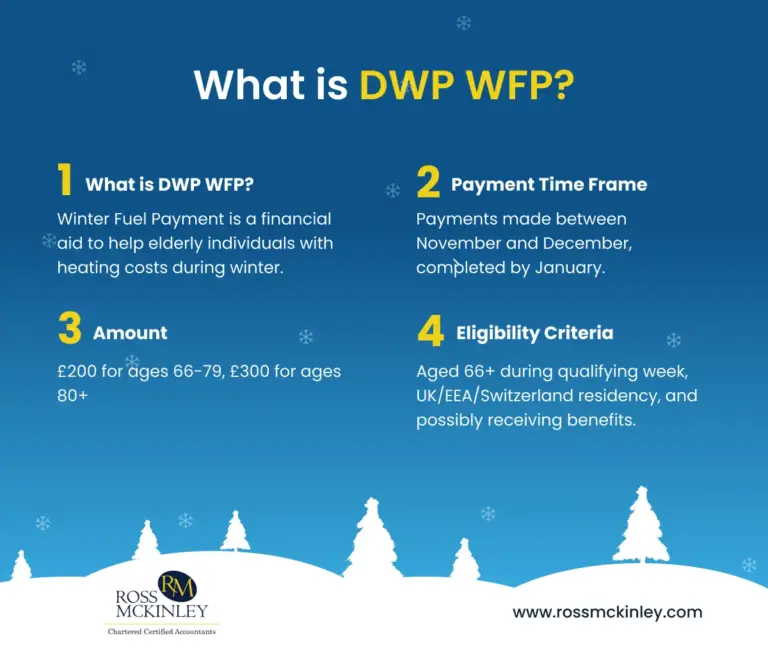

For the many pensioners across the UK who rely heavily on the state pension for their income, the outcome of the triple lock evaluation can mean the difference between financial security and hardship. Elderly people are disproportionately affected by rising living costs, particularly when it comes to essentials like food, heating, and healthcare, making the triple lock crucial for their welfare.

Conclusion

As the government prepares for the upcoming financial year, the fate of the triple lock state pension increase remains in the spotlight. Ensuring that pensioners are adequately supported will be a key test of the government’s commitment to social care and financial fairness. If the triple lock continues to be upheld, it may deliver a much-needed boost to pensioners’ income at a time when their financial health is under significant strain. However, discussions regarding the long-term future of the triple lock will likely continue, emphasizing the importance of maintaining a balance between fiscal responsibility and social welfare.