Introduction

The Federal Open Market Committee (FOMC) plays a crucial role in shaping monetary policy in the United States. Established by the Federal Reserve, the FOMC’s decisions influence economic growth, inflation rates, and employment levels across the nation. With an ever-changing economic landscape, the insights drawn from FOMC meetings are increasingly relevant for investors, businesses, and consumers alike.

The Latest FOMC Meeting

On March 22, 2023, the FOMC convened for its highly anticipated meeting, amid rising concerns about inflation and economic performance. Following extensive discussions, the committee decided to raise the federal funds rate by 25 basis points, bringing the target rate to 4.75% – 5.00%. This decision marks an ongoing effort by the Federal Reserve to curb inflation, which has consistently remained above the committee’s long-term target of 2%.

Key Discussions and Objectives

FOMC Chair Jerome Powell emphasised the committee’s commitment to achieving price stability as one of its primary objectives. In his post-meeting press conference, Powell noted the need for continued vigilance and the potential for further rate hikes in the upcoming months, contingent upon economic data.

Furthermore, the FOMC acknowledged challenges in the labour market, with job openings remaining high despite a slight increase in unemployment rates. This complex interplay of factors contributes to the committee’s cautious approach in navigating monetary policy adjustments.

Market Reactions and Implications

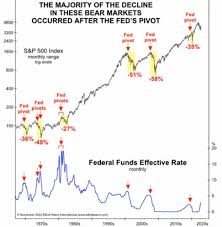

The announcement from the FOMC sent ripples across global markets. Major stock indices fluctuated as investors weighed the implications of the rate hike against the backdrop of ongoing inflation concerns. Treasury yields also responded, with short-term rates rising further as investors adjusted their expectations for future monetary policy.

Economists predict that the FOMC’s decision could lead to a gradual slowdown in economic activity. Many believe this is essential to achieve long-term price stability, although it carries the risk of dampening consumer spending and business investments in the near term.

Conclusion

As the FOMC continues to navigate through a volatile economic environment, their commitment to transparency and data-driven decision-making remains vital for market participants. Future FOMC meetings will provide further insights into how the committee plans to address inflation and economic growth challenges. For consumers and businesses alike, staying informed about the Federal Reserve’s policies is essential, as they lay the groundwork for the nation’s economic trajectory in the years to come.