Introduction

Federal rate cuts are a crucial economic tool used by the Federal Reserve (Fed) to influence economic activity and ensure financial stability. The Fed’s decision to adjust interest rates can significantly impact borrowing costs, consumer spending, and overall economic growth. As the global economy faces uncertainty due to inflationary pressures and other geopolitical issues, understanding the implications of fed rate cuts becomes increasingly important for investors, businesses, and consumers alike.

Recent Rate Cuts and Economic Context

In recent months, the Federal Reserve has made headlines by implementing a series of rate cuts aimed at counteracting slowing economic growth. In July 2023, the Fed reduced the benchmark interest rate by 25 basis points to stimulate spending and investment after signs of recession loomed. The continuous reshaping of monetary policy has sparked debate on its effectiveness, especially amidst concerns about inflation rates remaining persistently high. Historically, lowering interest rates is expected to promote borrowing; however, when inflation is outpacing wage growth, the benefits can be muted.

Impact on Different Sectors

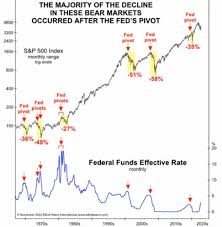

Fed rate cuts have divergent impacts across various sectors of the economy. For instance, the real estate and construction sectors tend to see a surge in activity as mortgages become cheaper, making homeownership more accessible. Conversely, financial institutions may experience reduced profit margins due to the lower rates affecting yields from loans and other interest-sensitive products. The stock market often reacts positively to rate cuts in the short term, as lower borrowing costs may drive corporate profits higher. However, investors wary of inflation may also look to equities with caution.

Conclusion and Future Outlook

As the economy navigates through these challenging times, the significance of Fed rate cuts cannot be overstated. While they are intended to spur growth and reduce unemployment, the underlying economic conditions must carefully be monitored to ensure these measures are effective. Future forecasts suggest that additional rate cuts may be necessary if inflation continues to hinder growth prospects. For readers, understanding the implications of such cuts is vital for making informed financial decisions and preparing for potential changes in the economic landscape.