The Importance of the Bank of England Base Rate

The Bank of England (BoE) base rate is a critical monetary policy tool that influences interest rates across the UK economy. When the base rate changes, it can have significant effects on borrowing costs, savings rates, and overall economic activity. As the UK continues to navigate a post-pandemic economy alongside challenges such as inflation and energy prices, understanding the base rate is more relevant than ever for consumers and businesses alike.

Recent Developments Around the Base Rate

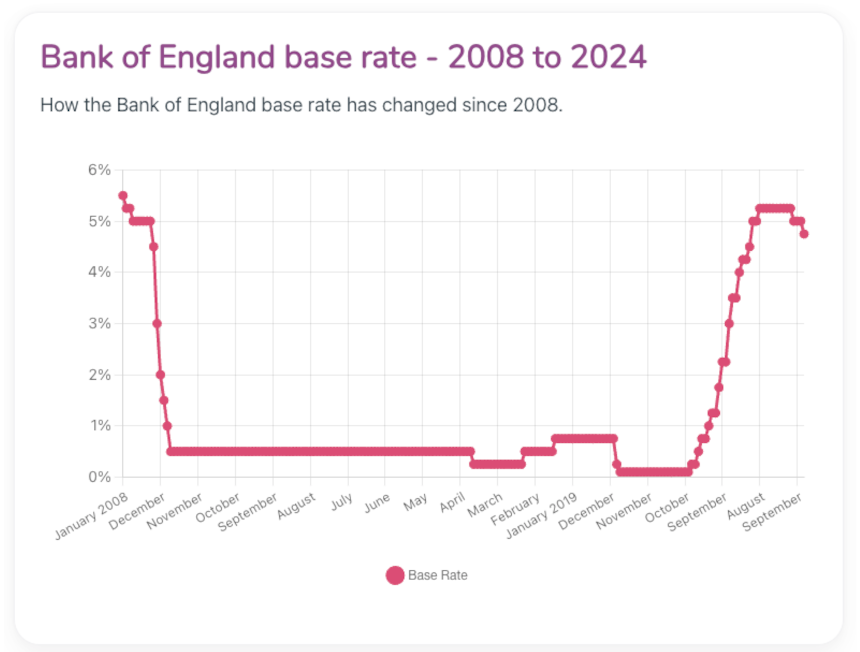

As of November 2023, the Bank of England has kept the base rate at 5.25%. This decision follows a series of rate hikes implemented earlier in the year aimed at curbing soaring inflation, which reached a peak of 11.1% in October 2022. The committee has closely monitored inflationary pressures driven by higher energy costs and supply chain disruptions. Since then, inflation has moderated, but the central bank remains cautious, citing ongoing risks.

Experts suggest that the BoE might consider adjusting the base rate again in the upcoming months. Recent data indicates that inflation has slightly decreased, but underlying pressures, including wage growth and global supply issues, are contributing factors in the decision-making process. Economists anticipate discussions on rate adjustments as the bank aims for its inflation target of 2% while also fostering economic growth.

Implications for Consumers and Businesses

The base rate significantly affects various financial products. For consumers with mortgages, a stable base rate means predictable repayments; however, any increase could lead to higher monthly expenses. On the other hand, savers may benefit from higher interest rates offered by banks as they respond to BoE’s rate changes.

Businesses, particularly small to medium enterprises, often require loans for operational needs. A higher base rate might deter borrowing due to increased costs, potentially slowing business expansion. Conversely, stabilised rates could encourage investment as firms feel more confident about future economic conditions.

Conclusion and Forward Outlook

Keeping abreast of the Bank of England base rate is essential for understanding the economic landscape in the UK. As inflation trends evolve, the BoE stands at a crossroads, with opportunities to either maintain the current rate or introduce changes depending on economic indicators.

In conclusion, whether you are a consumer, business owner, or investor, the decisions made by the Bank of England regarding the base rate will likely affect financial health and strategic planning in the upcoming months. Monitoring these developments closely will be crucial as the economic outlook remains dynamic.