Introduction to the UK State Pension Age

The state pension age in the UK is a significant issue affecting millions of citizens as it determines when they are eligible to receive pension benefits from the government. As life expectancy increases and the financial pressures on public spending grow, the government has been implementing changes to the pension age that affect both current and future retirees. Understanding changes to the state pension age is crucial for planning retirement and ensuring financial stability.

Current Status of the UK State Pension Age

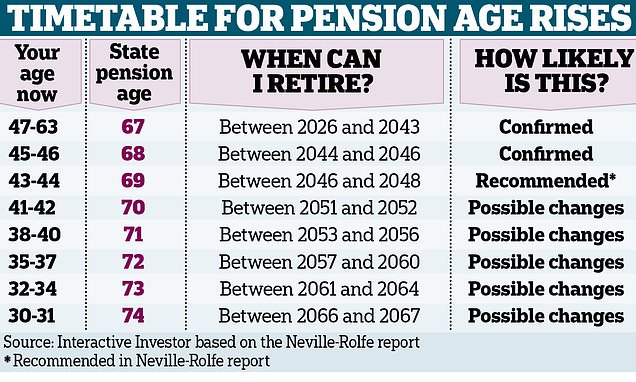

As of 2023, the state pension age in the UK is set at 66 years for both men and women. Future plans have been proposed to further raise the pension age to 67 by 2028 and potentially to 68 by 2037, depending on life expectancy trends.

The Department for Work and Pensions (DWP) outlined in the 2017 report that the state pension age will continue to be reviewed every five years with assessments conducted on anticipated increases in longevity. The rationale behind raising the pension age is to keep the pension system sustainable, ensuring that it does not overburden younger taxpayers while also providing adequate support for the aging population.

Public Response and Its Implications

The planned increase in the state pension age has sparked considerable debate among the public. Many people argue that raising the pension age disproportionately affects those in manual jobs, where physical work becomes challenging as one ages. Campaign groups, such as the “Waspi women” (Women Against State Pension Inequality), advocate for those who have been adversely affected by changes to the state pension age and claim that adequate notice and transitional measures have not been given.

Additionally, financial experts express concerns that prolonged working years could lead to health-related issues and push many older individuals out of the workforce due to age discrimination, particularly in physically demanding sectors.

Conclusion: The Future of the State Pension Age

As the government prepares for future reviews of the state pension age, it is essential for all citizens, especially those nearing retirement age, to stay informed about these adjustments. The state pension is projected to remain a crucial component of retirement income for many, making it important to engage in discussions surrounding its viability and sustainability.

In summary, the decisions taken now will shape the financial landscape for future generations, highlighting the need for informed planning and advocacy to ensure fair treatment across different demographics. It is vital for individuals to assess their retirement plans actively and consider alternative savings or investment strategies that could supplement income in retirement.