Introduction to Google Stock

The stock of Alphabet Inc., the parent company of Google, has become a focal point for investors and analysts alike, especially in a rapidly evolving technology landscape. Understanding the performance trends of Google Stock (NASDAQ: GOOGL) is critical for making informed investment decisions, given the company’s significant role in the digital economy.

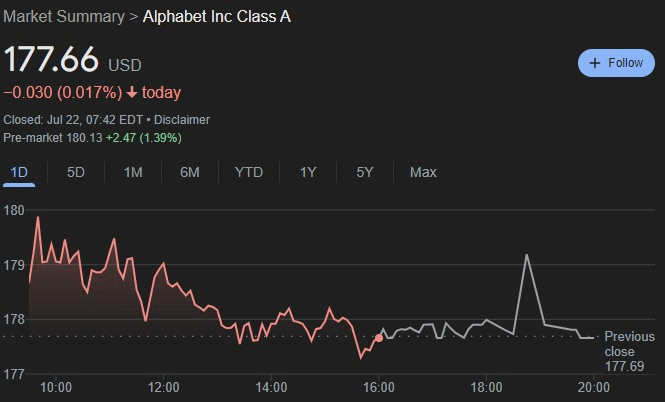

Recent Stock Performance

As of mid-October 2023, Google stock has shown considerable resilience, trading at approximately $141.50, up over 10% since the start of the quarter. The stock’s performance is attributed to a strong earnings report announced in September, where Alphabet revealed a revenue increase of 10%, reaching $70 billion. Analysts had expected more modest growth, highlighting the company’s effective cost management and robust advertising revenue that surpassed forecasts.

Market Trends and Analyst Opinions

Market trends indicate a growing confidence in Google due to its diversified revenue streams, including Google Cloud, YouTube, and its advertising business. Analysts at major investment banks, including Goldman Sachs and Morgan Stanley, have maintained a ‘Buy’ rating, suggesting an optimistic outlook on the company’s growth trajectory. Key developments in AI and machine learning, along with advancements in cloud computing, are anticipated to bolster Google’s position in the tech sector, attracting both retail and institutional investors.

Challenges and Competitor Landscape

Despite its strong position, Google faces ongoing challenges. Regulatory scrutiny remains a concern, particularly in the EU and US, which could impact future growth. Additionally, competition from rivals such as Microsoft in the cloud sector and TikTok in online advertising threatens to erode Google’s market share. These factors make it imperative for Alphabet to innovate continually and adapt its strategies accordingly.

Conclusion and Forecast

In conclusion, Google Stock presents a compelling investment opportunity, particularly given the company’s robust earnings and positive market sentiment. However, investors should remain vigilant regarding potential regulatory risks and competitive pressures. As we move towards 2024, analysts forecast continued growth in Google’s stock price, propelled by innovations in technology and sustained demand in the digital advertising market. For investors, closely monitoring these developments will be key to capitalising on Google’s potential in the evolving tech landscape.